401(k) plans can offer dramatically different contribution options. A plan’s governing legal document will define the contributions allowed. I recommend workers understand their plan’s options – which can be found in their Summary Plan Description (SPD). Otherwise, they could miss out on employer contributions, tax savings, or distribution opportunities.

401(k) plans can allow both employee and employer contributions. Here’s what workers need to know about the types a plan can offer today.

Employee Contributions

Employee contributions are deducted from wages based on the employee’s deferral election – which can be a dollar amount or percentage of pay. Below are the options a plan can allow:

- Elective deferrals – these contributions are deducted from employee wages on a pre-tax basis. Their amount – plus any earnings – are taxed at distribution.

- The IRC Section 402(g) limit caps the amount an employee can contribute annually. For 2025, the 402(g) limit is $23,500.

- Most plans allow participants age 50 or older to make catch-up contributions in excess of the 402(g) limit. For 2025, the catch-up limit is $7,500.

- Some plans include an automatic enrollment feature. Automatic enrollment allows an employer to automatically deduct elective deferrals from employee wages unless the employee makes an election not to contribute or to contribute a different amount.

- Roth contributions– Some 401(k) plans allow participants to designate a portion of their elective deferrals as Roth contributions. Unlike traditional elective deferrals, Roth contributions are contributed on an after-tax basis. As a result, they are non-taxable upon distribution. Their earnings can also be distributed tax-free when certain conditions apply. They are treated like pre-tax elective deferrals for many purposes, including:

- The IRC Section 402(g) limit

- Participant distributions

- The Actual Deferral Percentage (ADP) test

- Required Minimum Distributions

- Voluntary contributions– Few plans allow these contributions due to their impact on the Actual Contribution Percentage (ACP) test. Like Roth contributions, they are deducted from wages on an after-tax basis. Unlike Roth contributions, their earnings cannot be distributed tax-free.

Employer Contributions

Employers can help employees save for retirement by making employer contributions on behalf of their employees. Employer contributions can be matching or nonelective in nature.

- Matching contributions – 401(k) participants must make employee contributions to receive these contributions. A typical match is based on a percentage of elective deferrals up to a percentage of employee compensation – for example, 50% of elective deferrals up to 6% of compensation (3% total). A matching formula can also have multiple tiers – for example, 100% of elective deferrals up to 2% of compensation plus a 25% match on deferrals between 2% and 10% (4% total).

- Nonelective contributions – these contributions are allocated to all eligible participants – regardless of whether the participant makes employee contributions themselves. Profit sharing is the best known form of nonelective contribution.

Non-safe harbor contributions can be subject to a 3-year cliff or 6-year graded vesting schedule. They can also be subject to annual allocation conditions (e.g., participants must work 1,000 hours of service during the year to receive).

Safe Harbor Contributions

Safe harbor 401(k) plans must make a qualifying employer contribution to participants. A traditional safe harbor plan has the following options:

- Nonelective contribution – Must equal at least 3% of employee compensation.

- Basic match – 100% of elective deferrals up to 3% of compensation, plus 50% on the next 2% of compensation (4% total).

- Enhanced match – Must be at least as much as the basic match at each tier of the match formula. 100% match on the first 4% of compensation is common.

A Qualified Automatic Contribution Arrangement (QACA) safe harbor plan includes an automatic enrollment feature. QACA plans can allocate a less expensive match to participants than a traditional safe harbor plan. QACA match options include:

- Basic match – 100% of the first 1 percent of compensation, plus 50% on the next 5 percent of compensation (3.5% total).

- Enhanced match - must be at least as much as the QACA basic match at each tier of the match formula. 100% match on the first 3.5% of compensation is common.

Traditional safe harbor contributions are subject to 100% immediate vesting, while QACA safe harbor contributions can be subject to a 2-year cliff schedule.

Match-based safe harbor plans must distribution a notice to participants that discloses certain contribution information annually.

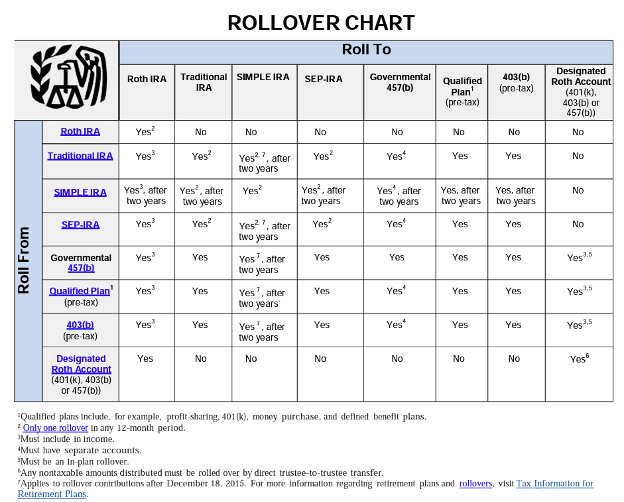

Rollover Contributions

401(k) plans can allow participants to make rollover contributions to their account. A rollover is a distribution from an eligible retirement account. Below the types of retirement accounts that can be rolled to a 401(k) account. A 401(k) plan can restrict these sources further.

When 401(k) Contributions Can Be Distributed

A 401(k) account withdrawal is called a distribution. 401(k) contributions cannot be distributed until a “distributable event” occurs. The events allowed by allow depend upon the contribution type. In general, a 401(k) plan can restrict these events further.

| Contribution Type | Distributable Events |

| Elective deferrals (including designated Roth Contributions and Catch-Up Contributions) |

Cannot be distributed until one of the following events occurs:

|

|

Voluntary Contributions |

Can be distributed at any time. |

|

Rollover Contributions |

Can be distributed at any time. |

|

Safe Harbor Employer Contributions |

Are subject to the same distribution requirements as elective deferrals. |

|

Non-Safe Harbor Employer Contributions |

Can be distributed at any age. |

Know Your Options to Not Miss Out!

To the uninitiated, all 401(k) plans can seem the same. In truth, they can offer dramatically different features, investments, and fees.

Contributions are a 401(k) feature that can differ dramatically between plans. By taking a few minutes to understand their plan’s options, workers can avoid missing out on valuable plan benefits.