The most expensive thing you will probably buy in your lifetime is retirement. Perhaps you’ve never thought of “buying” retirement, but that’s exactly what you do when you contribute to a 401(k) plan – save today to afford income in retirement. When you consider that income may need to last 10, 20, even 30 years, it’s easy to understand why retirement is not cheap.

Given the price tag of retirement, saving for it can seem overwhelming. In truth, a simple 3-step plan can make a secure retirement attainable for nearly any retirement saver - 1) save early and often, 2) invest appropriately, and 3) keep account fees to a minimum.

Step 3 can require the most education due to the confusing array of possible 401(k) fees. The U.S. Department of Labor (DOL) breaks them into three major categories - Investment Fees, Administration Fees, and Individual Service Fees.

1. Investment Fees

Investment fees are paid from fund expenses. They lower 401(k) account returns by increasing the cost of investing. They fall into one of two general categories – shareholder fees and operating expenses. Shareholder fees apply to individual investor transactions and account maintenance, while operating expenses cover regular and recurring fund expenses. Mutual fund companies are obligated by law to disclose these fees in their prospectus.

Shareholder expenses can include:

- Sales loads – are basically a commission. They are paid to a salesperson – usually a broker. There are two general types. A “front-end” sales load reduces the dollar amount available to purchase fund shares. A “back-end “(or “deferred”) sales load reduces the proceeds from a redemption (sale) of fund shares.

- Redemption fees – are deducted from redemption proceeds like a deferred sales load, but they are paid to the fund company instead of the salesperson. The fee is intended to defray fund expenses related to share redemptions.

- Purchase fees – reduce the amount available to purchase fund shares like a front-end sales load, but they are paid to the fund company instead of the salesperson. The fee is intended to defray fund expenses related to share purchases.

- Exchange fees – are imposed by some funds when its shares are exchanged for the shares of another fund.

- Account fees – are imposed by some funds when account falls below a minimum balance.

Operating expenses can include:

- Management fees – are paid out of fund assets to the fund’s investment adviser for portfolio management.

- Distribution and/or service 12b-1 fees – are paid out of fund assets for marketing and selling fund shares, such as compensating brokers and others who sell fund shares. "12b-1 fees" get their name from the SEC rule that authorizes a fund to pay them.

- Other Expenses - are expenses not included in the other two categories. Examples include custodial expenses, legal expenses, accounting expenses, transfer agent expenses, and other administrative expenses.

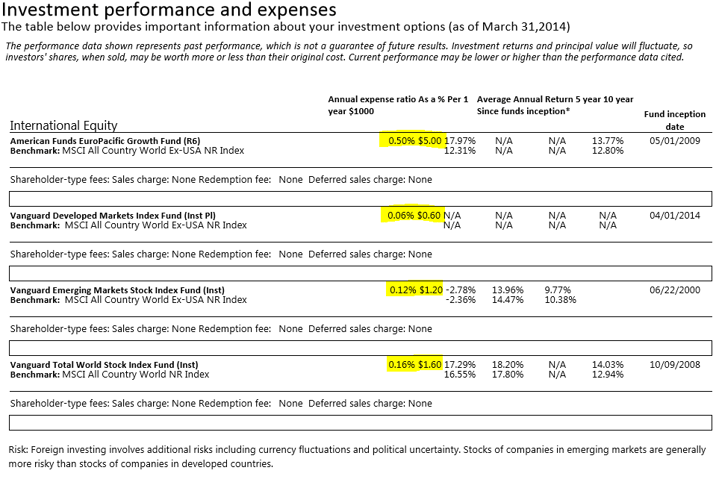

Here’s an example of how investment fees are disclosed in one 401(k) plan's annual participant fee disclosure:

Investment fees generally range anywhere from 0.03% - 2% of plan assets. On the low-end of the range, you have low-cost, passively managed index funds from companies like Vanguard, which track the performance of the market and require little-to-no oversight. On the high-end, you have actively managed funds which attempt (and usually fail) to beat the market on a net-of-fees basis over time. How much you’re paying depends on the funds in your plan, and how your account is allocated among these funds.

401(k) investment fees are extremely important to pay attention to, but they’re only one part of the equation.

2. Administration Fees

401(k) administration fees cover all the back-office functions required to run a 401(k) plan. These include keeping track of where everyone’s money is (recordkeeping), preparing annual nondiscrimination testing and Form 5500s (third-party administration), and holding assets and executing trades on behalf of participants (asset custody).

When 401(k) administration fees are can be “direct” or “indirect” in nature. Direct fees can be paid by the plan sponsor or deducted from participant accounts. while indirect fees increase the cost of 401(k) investments - lowering their returns. Direct fees are by the most transparent. Their dollar amount must be explicitly reported in participant fee disclosures. In contrast, indirect fees can be buried in fund expense ratios - making their amount less obvious.

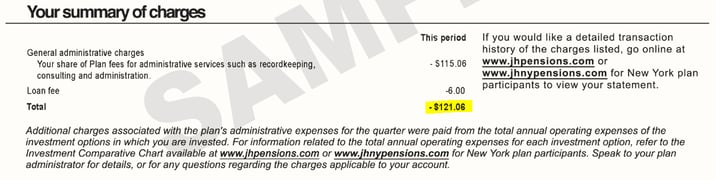

When direct administration fees are deducted from your 401(k) account, you can can find the amount deducted in your quarterly benefit statements. Below is an example:

Asset-Based Administration Fees are Bad

Many 401(k) providers charge asset-based administration fees. The problem? Except for asset custody, administration services scale with employee headcount – not assets. That means asset-based administration fees can quickly outstretch a 401(k) provider's level of service when plan assets increase - resulting in excessive fees that lower your account returns needlessly.

So why do 401(k) providers charge administration fees that do not match their level of service? Profit. Asset-based administration fees automatically make growing 401(k) plans more profitable.

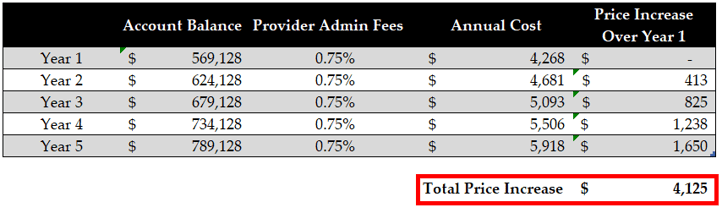

Below is a demonstration of the problem assuming a hypothetical 401(k) account:

Over five years, this 401(k) account would pay any additional $4,125 in administration fees for roughly the same level of service!

In our view, an asset-based 401(k) administration fee over 0.10% - enough to cover asset custody - is unnecessary and can lead to you and your participants overpaying for plan administration services.

Indirect Administration Fees are Worse

Indirect 401(k) administration fees are often called "hidden" 401(k) fees because the lack the transparency of direct fees. They come in two basic forms:

- Revenue sharing - Revenue sharing is the practice of adding non-investment related fees to the operating expenses of a mutual fund. These additional fees are then paid out to plan service providers. There are two general forms:

- 12b-1 fees – usually paid to a broker or insurance agent.

- Sub-Transfer Agency (sub-TA) fees – usually paid to a recordkeeper.

- “Wrap” fees – Insurance companies often use variable annuities instead of mutual funds as 401(k) investments. A variable annuity is basically a mutual fund wrapped in a thin layer of insurance with additional fees and redemption restrictions. The additional fees usually include a “wrap” fee that can increase the expense ratio of the underlying mutual fund dramatically. Sometimes by more than 1%!

401(k) providers have no obligation to disclose the dollar amount of revenue sharing and wrap fees in their 408b-2 fee disclosure. Instead, they can bury their rate in the expense ratio of plan investment options.

3. Individual Service Fees

Individual service fees are charged to participants on a per-transaction basis for various features or services they might use. These include:

- Taking out a loan from your 401(k)

- Rolling your 401(k) assets into an IRA

- Financial advisory services

- Executing trades within a brokerage window

- Making a hardship withdrawal from your 401(k)

- Making a regular withdrawal after terminating employment

These are generally the smallest portion of fees paid, but it can be frustrating to be saddled unexpectedly with a transaction fee. Be sure to receive an itemized list of every individual service fee from your provider, and make sure they’re reasonable.