401(k) plan fiduciaries are often concerned about their fiduciary liability – little surprise when they can be personally liable for fiduciary failures. To mitigate this risk, fiduciaries must understand the sources of liability. A way to do that is asking insurance companies about the factors that increase the price of 401(k) fiduciary liability insurance.

Recently, Aon - one of the world’s largest providers of risk management, retirement, and health services - surveyed top insurance companies about that question. They published their findings – including key takeaways - in a white paper. If you are 401(k) plan fiduciary, I recommend you check it out. The paper includes some valuable insights into the drivers of 401(k) fiduciary liability.

Here are some excerpts from the Aon white paper and my thoughts on their top takeaway.

About 401(k) Fiduciary Liability Insurance

The Aon white paper included one of the best explanations of 401(k) fiduciary liability insurance – which is optional – I have ever read:

“If you have discretionary authority for the management or administration of an employee benefit plan that is subject to the Employee Retirement Income Security Act (ERISA), or if you exercise any authority of control with respect to the management or disposition of the assets of an ERISA plan, then you are considered a fiduciary of that plan. Under ERISA, plan fiduciaries shall be personally liable for fiduciary failures, meaning that your personal assets could be at risk. In a worst-case scenario, even bankruptcy would not offer protection.

An ERISA bond will not offer protection against breaches of fiduciary duty. Under ERISA, plan fiduciaries and those who handle plan funds or assets must be bonded to protect the plan from losses caused by dishonest or fraudulent actions. But the ERISA fidelity bonds that you are legally required to purchase will not protect from losses arising from breaches of fiduciary duty (such as the failure to prudently invest plan assets) or plan administrative errors. These exposures require fiduciary liability insurance.

Fiduciary liability insurance is designed to provide coverage for:

- The Company/Sponsor Organization and its subsidiaries

- Covered Plans including: – Qualified Retirement and Health and Welfare Plans – e.g., Welfare (such as medical, dental, life insurance, disability and accident plans); Pension (defined benefit and defined contribution plans) – Non-Qualified Plans – e.g., deferred compensation programs, excess benefit plans, and supplemental executive retirement programs

- Insured Persons – i.e., any natural person serving as a past, present or future director, officer, partner, or employee of the Sponsor Organization or a Plan, in his/her capacity as a Fiduciary, Administrator or trustee of a Plan

Covered claims may include:

- Breaches of Fiduciary Duty – violations of fiduciary obligations, responsibilities or duties under Employee Benefits Law (including ERISA)

- Administration – acts, errors or omissions in the administration of a Plan, such as:

- Advising, counseling, or giving notice to employees, participants and beneficiaries

- Providing interpretations

- Handling records

- Activities affecting enrollment, termination or cancellation of employees, participants, and beneficiaries under the Plan”

Aon Survey Results

According to Aon, “Understanding what drives pricing for fiduciary liability insurance is not just about managing those insurance costs, but also about understanding and managing fiduciary risks themselves—that is, avoiding a lawsuit altogether.”

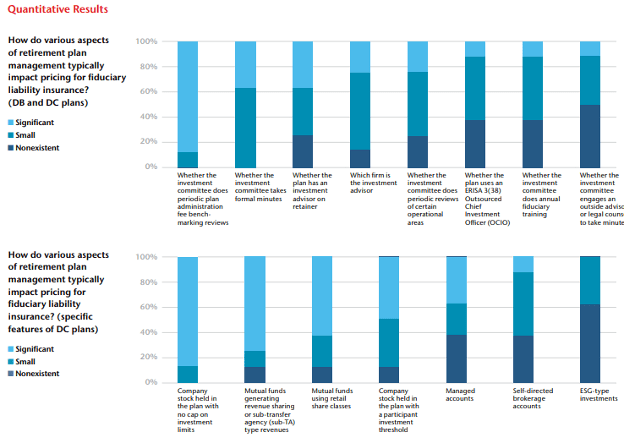

To this end, Aon surveyed top insurance companies providing fiduciary liability insurance coverage to understand how plan management typically impacts pricing for fiduciary liability insurance. Their survey focused on areas within the control of fiduciaries for defined benefit (DB) plans – commonly called pensions - and defined contribution (DC) plans – which includes 401(k) plans.

For each area, Aon asked insurers to characterize the impact on premiums as significant, small, or nonexistent

Below is a summary of their findings:

The Top Takeaway - Fees Are Very Important

The Aon white paper includes five key survey takeaways. The top takeaway – fees are very important. According to Aon, “For those following ERISA litigation over the past several years, it should come as no surprise that the questions about fee levels and structures as well as processes for reviewing fees ranked as top drivers of fiduciary liability insurance premiums.”

- 75% of respondents said that it was a significant driver of insurance premiums if plans use mutual funds that pay revenue sharing.

- Revenue sharing is a form of "indirect" 401(k) administration fee. Mutual fund companies add these fees the operating expenses of some funds and then pay them out to plan service providers. Revenue sharing lowers the investment returns of plan participants dollar-for-dollar. 12b-1 and Sub-Transfer Agency (Sub-TA) fees are the two most common forms

- 63% said mutual funds using retail share classes would be a significant driver of premiums.

My Thoughts

I’m not surprised at all Aon found revenue sharing to be a significant driver of insurance premiums. I consider this 401(k) provider compensation a risky bet for plan fiduciaries for the following reasons:

- Revenue sharing lacks transparency – “Direct” 401(k) administration fees - which employers can either pay from a corporate bank account or allocate among plan participants – are the most transparent form of 401(k) provider compensation. Its dollar amount must be explicitly disclosed in 408b-2 and 404a-5 fee disclosures, plan financials, and participant statements, In contrast, revenue sharing can be estimated in 408b-2 disclosures, buried in the fund expense ratios of 404a-5 disclosures, and not appear at all in plan financials or participant statements.

- Revenue sharing can outstretch your level of service - Revenue sharing is paid based on a percentage of plan assets. That’s problematic because most 401(k) administration services scale (i.e., increase) with employee headcount, not assets. This disconnect can result in a 401(k) plan with lots of assets paying much higher fees than a comparable plan with fewer assets for the same level of administration services. That’s not right and a potential source of fiduciary liability.

- Revenue sharing can limit your access to top investments - Studies show passive funds – which include index funds and ETFs - outperform most comparable active funds over time, net of fees. Passive funds from leading providers like Vanguard, Blackrock, and Schwab pay no revenue sharing. To receive revenue sharing, a 401(k) provider could prohibit access to these funds.

- Revenue sharing is often unfair – In general, ERISAis silent about acceptable method(s) for allocating 401(k) administration fees amongst plan participants – it only says the method used must be “reasonable.” Reasonable usually means pro rata or per capita. Unless all 401(k) plan investments pay the same rate of revenue sharing, participants will pay a different rate of administration fees. That means participants invested in funds that pay a high rate of revenue sharing will pay a disproportionate share of administration fees.

Fortunately, revenue sharing is easy to avoid. You just need to hire a 401(k) provider with 100% direct administration fees.

Steer Clear of 401(k) Liability to Protect Participant Interests!

I do not carry 401(k) fiduciary liability insurance as plan fiduciary myself. My firm’s 401(k) plan has relatively few assets and I don’t find it particularly difficult to meet my 401(k) fiduciary responsibilities – which I view as pretty common sense. However, I completely understand why other plan fiduciaries might consider the insurance worth the price.

That said, regardless of your view on the 401(k) fiduciary liability insurance, understanding the factors that increase the price of 401(k) fiduciary liability insurance can help you avoid fiduciary pitfalls – and in turn, ensure a higher quality retirement plan for you and your employees!