When a business owner needs help picking investments for their 401(k) plan, my advice to them is always the same – hire a fiduciary-grade 401(k) financial advisor. The reason – only advisors bound by a fiduciary standard of care have a legal obligation to give impartial investment advice to their clients. In contrast, it’s perfectly legal for non-fiduciary advisors – who are bound by a lesser “suitability” standard – to give conflicted advice by steering their clients towards high-commission investments when lower-cost alternatives exist. In general, fiduciary-grade 401(k) advisors include investment advisers, but not brokers and insurance agents.

The irony? Even though fiduciary-grade 401(k) financial advisors are bound by a higher standard of care than non-fiduciaries, their investment advice often costs less. Don’t take my word for it. Check out our latest fee study of fiduciary-grade 401(k) advisors.

401(k) Financial Advisor Fees – A Study of 860 Plans

Employee Fiduciary partners with hundreds of 401(k) financial advisors nationwide. All of them are investment advisers, making each subject to a fiduciary standard of care.

Recently, we studied the fiduciary-grade advisor fees paid by 860 401(k) plans annually. The following table summarizes our findings. Please note our study does not account for the depth and breadth of each advisor’s services.

|

Plan Asset Range |

$0-$500k (416 plans) |

$500k-$1M (158 plans) |

$1M-$5M (286 plans) |

|

Average Assets |

$190,972.31 |

$719,153.07 |

$2,082,352.02 |

|

Average Participants |

13 |

24 |

34 |

|

Range |

0.02% - 9.36% |

0.16% - 2.00% |

0.05% - 1.00% |

|

Average |

0.70% |

0.67% |

0.56% |

|

Median |

0.50% |

0.65% |

0.50% |

|

Formulas Used |

|||

|

Flat Fee |

5 |

5 |

16 |

|

Flat Percent |

291 |

98 |

204 |

|

Flat Percent with Min |

14 |

4 |

2 |

|

Flat Percent Plus Flat Fee |

0 |

2 |

4 |

|

Tier |

102 |

43 |

54 |

|

Tier with Minimum |

4 |

6 |

6 |

Click here to view a plan-level breakdown of our study.

Studying Fiduciary-Grade Advisor Fees as Part of a “Bundled” 401(k) Solution

All 401(k) plans require three basic administration services – asset custody, participant recordkeeping and Third-Party Administration (TPA). Employee Fiduciary provides all of them. Financial advisors ally with service providers like Employee Fiduciary to offer a “bundled” (complete) 401(k) solution to employers.

When evaluating the fees charged by a 401(k) financial advisor, employers should do so within the context of the total fees charged under the bundled solution. By adding financial advisor fees from the prior table to Employee Fiduciary fees, average total plan fees can be determined.

|

Plan Asset Range |

$0-$500k (416 plans) |

$500k-$1M (158 plans) |

$1M-$5M (286 plans) |

|

Employee Fiduciary Fees* |

$1,652.78 |

$2,075.32 |

$3,271.51 |

|

Advisor Fee* |

$1,342.98 |

$4,843.14 |

$11,596.09 |

|

Total |

$2,995.76 |

$6,918.46 |

$14,867.60 |

|

Percentage of Assets |

1.57% |

0.96% |

0.71% |

*Based on average assets and participants.

These figures do not include investment expense ratios. That said, most of the financial advisors that partner with Employee Fiduciary use low cost investments like index funds and ETFs in their fund menus. The average expense ratio of a menu using these funds can be as low as 0.10% of plan assets.

Key Takeaway - Fiduciary-Grade Advice Lowers the Cost of 401(k) Plans

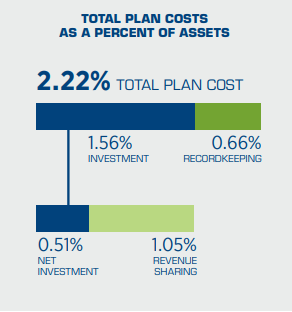

The 401k Averages Book is an often-cited source for 401(k) benchmarks. For 2020, they found that 401(k) plans with $500,000 in assets paid an average of 1.71% for bundled administration services (0.66% recordkeeping + 1.05% revenue sharing). That’s higher than the 1.57% average we found for plans with much fewer assets ($190,972.31 on average).

Hiring a Non-Fiduciary 401(k) Financial Advisor Can Be a Costly Mistake!

When employers need assistance in selecting and monitoring investments for their 401(k) plan, they deserve professional advice that puts the interests of their plan participants first. Today, only fiduciary-grade financial advisors are obligated by law to do deliver that. The kicker? Their advice is often less expensive than conflicted advice by brokers and insurance agents. In our view, there is no reason for employers to settle for less.