The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) created a new participant disclosure requirement for 401(k) plans. To meet the new requirement, benefit statements must include a “lifetime income” disclosure at least annually to help plan participants understand how much income their current account balance could produce in retirement. I think the new disclosure will help 401(k) participants set better savings goals for retirement.

In my experience, 401(k) participants tend to underestimate the savings they’ll need to sustain their desired level of income in retirement. For example, $100,000 can seem like ample savings until you realize it would only pay a 65-year-old about $500-600 per month in lifetime income.

Here's what you can expect to see on your disclosure, including its assumptions and limitations.

Lifetime Income Disclosure Requirements

The lifetime income disclosure must be “written in a manner calculated to be understood by the average plan participant” and include:

- The statement period beginning and ending dates.

- The participant’s account balance as of the last day of the statement period, expressed as a lifetime income stream payable in equal monthly payments for

- the life of the participant (i.e., a single life annuity), and

- the joint lives of the participant and spouse (i.e., a qualified joint and survivor annuity).

In an interim final rule the Department of Labor (DOL) prescribed a set of assumptions that must be used when converting a participant’s current account balance to single life and qualified joint and survivor annuities. These assumptions include:

- Annuity start date – the last day of the benefit statement period.

- Age on annuity start date – age 67 or actual age if older than 67.

- In other words, payments do not assume future account growth.

- Qualified joint and survivor annuity (QJSA) assumptions:

- The participant has a spouse of equal age, regardless of the participant’s actual marital status or the actual age of their spouse.

- The QJSA provides a 100% survivor benefit.

- Interest rate - the 10-year constant maturity Treasury rate (10-year CMT) as of the first business day of the last month of the statement period

- Mortality - Unisex mortality as described in Internal Revenue Code (IRC) Section 417(e) for defined benefit pension plans.

- Participant loans - account balance includes outstanding loans not in default.

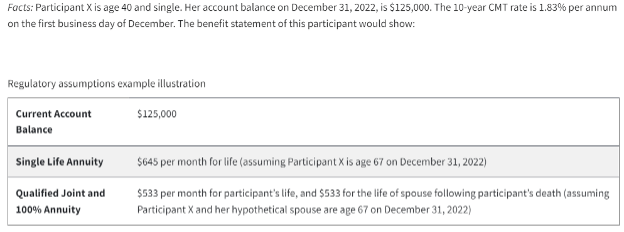

The following example from the DOL illustrates the application of these assumptions:

Lifetime Income Disclosure Explanations

Lifetime income disclosures must explain the annuity illustrations. The DOL provided model language for these explanations in their interim final rule. Below is a list of the required explanations.

- An explanation of the commencement date and age assumptions

- An explanation of a single-life annuity

- An explanation of a qualified joint and 100% survivor annuity, the availability of other survivor percentage annuities, and the impact of choosing a lower survivor percentage

- An explanation of the marital status assumptions

- An explanation of the interest rate assumptions

- An explanation of the mortality assumptions

- An explanation that the monthly payment amounts are illustrations only

- An explanation that the actual monthly payments that may be purchased will depend on numerous factors and may vary substantially from the illustrations.

- An explanation that the monthly payment amounts are fixed amounts that would not increase for inflation.

- An explanation that the monthly payment amounts required are based on total benefits accrued, regardless of whether such benefits are nonforfeitable.

- An explanation that the account balance includes the outstanding balance of any participant loan, unless the participant is in default of repayment on such loan.

Not Perfect but a Step in the Right Direction!

The new lifetime income disclosure is hardly perfect. I think using a participant’s current account balance and assuming the participant is age 67, rather than projecting the account balance to an assumed retirement age, can produce misleading results.

That said, there’s no shortage of free retirement-income calculators online that can help 401(k) participant further fine-tune their savings goal based on the future growth of their account, outside assets, marital status, etc. Two of the best are offered by AARP and the American Institute of Certified Public Accountants.