401(k) plans are designed to help workers save for retirement. Unfortunately, 401(k) accounts often reduced prior to retirement by loans that are not repaid, hardship withdrawals, and cash-outs resulting from a job change. Experts call these reductions “leakage.” 401(k) leakage can greatly reduce a worker’s

retirement security.

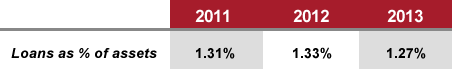

According to the Plan Sponsor Council of America (PSCA), approximately 90% of 401(k) plans allow loans. Of those participants with access to loans, about 21% carry loan balances, accounting for about 2% of all 401(k) assets, per the Investment Company Institutue (ICI). For Employee Fiduciary clients, the

percentage of total plan assets in participant loans as of 12/31/xx were as follows:

Percentage of index funds as of 12/31/xx

We found participants in Employee Fiduciary plans were utilized loans at a rate well below the national average. Further, utilization has declined over the last three years. Our participants are borrowing less. How and why?

Our clients overwhelmingly choose not to allow loans in their small business 401(k) plans.

Of all Employee Fiduciary clients, only 33% of plans allow loans. Loans add complexity to plan administration, and are potentially expensive to administer. In addition, employees with loan balances who leave a job are forced to immediately repay the entire loan balance or take a tax hit. Loans can torpedo the ability of employees to effectively save for retirement.Contrary to conventional wisdom, small business 401k plan sponsors are opting to forego loans in favor of a streamlined plan that focuses on long term retirement readiness, not short term cash flows. Business owners view plan loans as adding risk and complexity, and therefore steer away from them. The key to keeping loan balances low – just don’t offer them in the plan.

We see a similar trend in hardship withdrawals.

Hardships account for a fraction of plan leakage compared to loans, but our client data mirrors the experience with loans. Hardships as a percentage of plan assets has fallen from 0.27% in 2011 to 0.12% in 2013. Among our clients, only 9% reported hardships in 2013. Nationally, about 85% of 401(k) plans

allow hardship withdrawals – typically to preserve a primary residence or severe medical expenses. Like loans, hardship provisions are potentially expensive to administer and create another avenue for plan leakage. Again, small business owners are choosing simplicity and lower costs – and helping employees stay invested in the plan.

Small business owners want “to do the right thing.”

Time and again, our plan sponsors want to take full advantage of the tax incentives available through retirement savings plans AND they want to provide a true benefit to their employees. The two goals are not mutually exclusive. Opting away from plan loans and hardships shuts off the potential for plan asset leakage, and keeps employee contributions invested in the plan for the long term.

In short, our clients are using their 401(k) plans to invest now and stay invested for the long term. Their 401(k) plans are being used to save for retirement – the ultimate “right thing” to do.

Summing up: What we have learned from our client data.

Small business clients like simple. In order to start a small business 401(k) plan, business owners and leaders need to understand the hows and whys of the plan. They are wary of fast talk and sales pitches that tend to complicate and confuse, resulting in a “just trust me” bottom line. As seen with the use of passive index investments and target date funds, plan sponsors understand the approach and are willing to make use of these investments. They are looking for providers who will help them implement the strategy.

Small business 401(k) plan sponsors choose value over sizzle. Small plan administrators realize that passive investments will not outperform the market – ever. They do, however, recognize the value provided by that approach and specifically avoid the risks higher fees add to the underlying investment

proposition.

Small businesses value employees and provide incentives to stay invested. The vast majority of plan sponsors we polled have a vested interest in the plans they provide to employees – they are employees as well – and want to do the best for all involved. Sponsors see the value in a frugal approach and believe their employees will, too. Pursuing best practices keeps costs low and maximizes the employees’ ability to prepare for retirement.

The conventional wisdom for small business 401(k) plans is that smaller companies pay more, get less and are not nearly as sophisticated as larger plans. Our data suggest that smaller plans choosing a disciplined, low-risk approach to plan administration and investment selection do quite well in comparison with some of the largest employers.