As a business owner, you want to understand the basic fiduciary hierarchy applicable to all 401(k) plans and the responsibilities of each role within it. This understanding can make the oversight of your 401(k) plan – basically ensuring that your fiduciary responsibilities are met – much more straightforward.

The 401(k) fiduciary hierarchy includes both fiduciary and non-fiduciary (“ministerial”) roles. In general, the fiduciary roles have discretionary power, while the ministerial roles do not. The named fiduciary sits atop the hierarchy with the power to delegate all other roles.

In most traditional (single-employer) 401(k) plans, the named fiduciary is the employer - which includes controlled groups and affiliated service groups. In a Multiple-Employer Plan (MEP), it is the provider. In a Pooled Employer Plan (PEP), it is the Pooled Plan Provider.

You can delegate any role within the fiduciary hierarchy to a willing 401(k) provider, but there is a catch. You must “monitor” their performance of each role you delegate – to ensure they are doing a competent job for “reasonable” fees. Given this responsibility, I recommend you avoid 401(k) providers with opaque administration services, investments, or fees you don't understand.

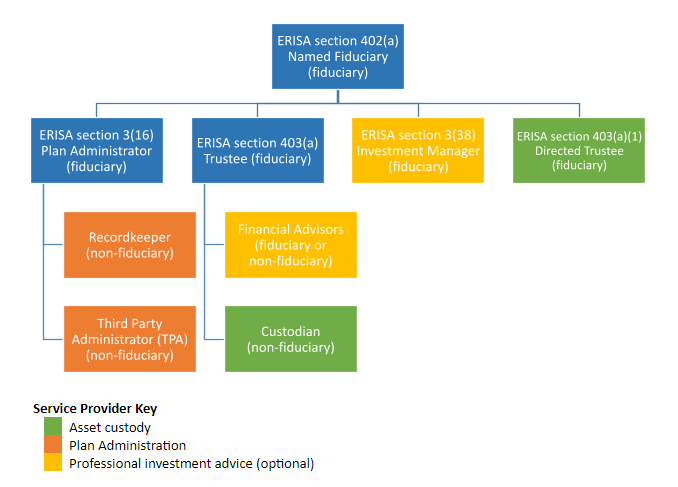

An Org Chart of the 401(k) Fiduciary Hierarchy

An org chart of the 401(k) fiduciary hierarchy can be found below. The blue boxes indicate roles most often filled by an employer. These roles have the broadest discretionary authority – which also makes them the most prone to abuse when delegated. The other boxes indicate roles most often filled by professional service providers.

- ERISA section 402(a) Named Fiduciary – is designated in the plan document as having the overall authority to control and manage the operation and administration of the plan. Most commonly, the Named Fiduciary is the ERISA section 3(16) Plan Administrator

- ERISA section 3(16) Plan Administrator – is the person or entity "so designated" in the plan document. The employer is the default Plan Administrator if none is designated. The Plan Administrator is basically responsible for any fiduciary responsibility not assumed by the ERISA section 403(a) Trustee.

- This definition should not be confused with the “3(16)” administration services sold by some 401(k) providers. Most of these services simply grant a 401(k) provider the blanket authority to perform basic ERISA section 3(16) functions like approving participant distribution requests or filing a Form 5500.

- ERISA section 403(a) Trustee – is named in a 401(k) plan or trust document and has exclusive authority and discretion to manage and control plan assets.

- ERISA section 3(38) Investment Manager – is a type of financial advisor that assumes sole responsibility for investment selection and monitoring. When an Investment Manager is hired, the Trustee is not responsible for plan assets controlled by the Investment Manager. An Investment Manager must be a bank, an insurance company, or a financial advisor subject to the Investment Advisers Act of 1940.

- ERISA section 403(a)(1) Directed Trustee – is a type of trustee that lacks the discretionary authority of a full 403(a) Trustee. They must act at the direction of the Named Fiduciary in accordance with the terms of the plan document and ERISA.

- Recordkeeper – is responsible for tracking contributions, earnings and investments on a participant-level and directing the Directed Trustee or Custodian (as applicable) to execute trades requested by plan participants.

- Third-Party Administrator (TPA) – is responsible for annual ERISA compliance (nondiscrimination testing, Form 5500, plan document maintenance, participant notice preparation).

- Financial Advisors – are financial professionals, other than a 3(38) Investment Manager, that render professional investment advice for a fee. Unfortunately, there is a confusing array of financial advisors in the 401(k) market. The major difference between them is their required standard of care.

- Investment advisers - are subject to a fiduciary standard of care under the Investment Advisers Act of 1940. They are generally paid a flat fee regardless of the advice given.

- Brokers and insurance agents - are subject to a lesser suitability standard, which does not forbid conflicts of interest (like the fiduciary standard). Compensation for these advisors can vary based on the advice given, which can result in conflicts of interest.

- Custodian – holds plan assets like a Directed Trustee but is not subject to a fiduciary standard of care.

401(k) Plan Oversight Should Not Be Scary!

Employers have a fiduciary responsibility to monitor their 401(k) provider because they are ultimately responsible for protecting the interests of their plan participants. That responsibility can seem scary because failing to meet it can mean personal liability for restoring avoidable participant losses.

In truth, the top sources of 401(k) fiduciary liability today - excessive fees, imprudent investment selection, and self-dealing – are not difficult to avoid. You just need to hire a 401(k) provider willing to deliver a plan with three basic features - leading index funds, flat fees, and unambiguous administration services that make your plan oversight role straightforward.