401(k) plans and IRAs tend to offer mutual funds to their investors in different share classes - 401(k) plans tend to offer institutional shares, while IRAs tend to offer retail shares. The biggest difference between these categories is cost – retail shares charge higher fees. A recent brief by The Pew Charitable Trusts calculated the additional cost of retail shares and how much rolling an institutional 401(k) account to a retail IRA can cost investors in retirement. The amount is probably more than you think.

If you need help evaluating your 401(k) rollover options after leaving a job, I consider the Pew brief a must-read. Here are some of the highlights.

Pew’s Analysis of Institutional and Retail Mutual Fund Fees

For their brief, Pew defined the institutional and retail share class categories as follows:

- Institutional shares: typically require a large initial investment (the minimum can be in excess of $100,000), making them available to institutional investors, such as employer-sponsored retirement plans, that pool workers’ contributions or to individuals who are able to meet the minimum requirements. These share classes typically have the lowest expenses.

- Retail shares: have low minimum investment requirements or sometimes no minimums. These shares tend to be broadly accessible to all investors but often have higher expenses than institutional shares do.

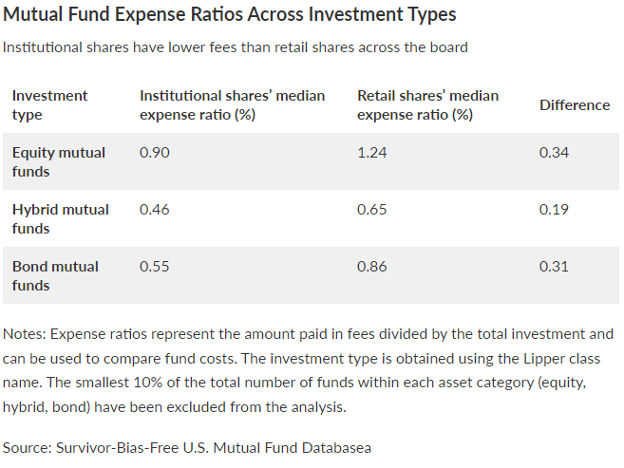

After analyzing “the difference between institutional and retail class annual expenses across all mutual funds that offered at least one institutional and one retail share in 2019”, Pew found:

- For mutual funds that primarily hold equities, costs are significantly greater for retail shares. Annual expenses for median retail shares were 0.34 percentage points higher than those for institutional shares. Although this seems like a small difference, it represents about 37% higher fees.

- Mutual funds that hold both equities and bonds—known as hybrid funds—and bond mutual funds have lower expenses than equity funds do. And that means that small differences can represent large comparative trade-offs when looking at the costs associated with retail and institutional shares. Median retail share expenses are about 41% higher for hybrid funds (a difference of 0.19 percentage points) and 56% higher for bond funds (a 0.31 percentage-point difference) compared with median institutional share expenses.

- In the aggregate, looking at the smallest median fee difference shows a large potential impact on the long-term savings of those invested in retail shares. Applying the 0.19 percentage-point difference seen for hybrid funds to the entire $516.7 billion in rollover assets in 2018 amounts to more than $980 million in direct fees in a single year alone. That translates into tens of billions of dollars in potential losses to savings related to fees and forgone earnings over a 25-year period.

- Clear, accessible information about fees is needed. Employers also should consider offering services that help retirees and others leaving their jobs make decisions that help them minimize fee costs. Among the options could be keeping their investments in a workplace 401(k) plan if permitted.

Below is a summary of the median fund-level asset-weighted annual expense ratios found by Pew:

How Much Can Retail Shares Cost Investors in Retirement

In their brief, Pew demonstrates how the median fees they found would affect the future retirement savings of three hypothetical investors:

Example 1: A Recent Retiree

Sarah is retiring at age 65 after a long career. She has $250,000 in her employer’s 401(k) plan and now must decide whether to keep the money there or roll it over into an IRA. She likes the hybrid mutual fund in which her savings are currently invested, so if she does roll the money over, she wants to put it in the same mutual fund. However, the fund’s fees in the 401(k) plan are much lower than in the IRA—even though it is the same fund. For Sarah, the question is whether the difference in fees matters for her retirement security. Here are details that she should consider:

- Total savings: $250,000

- Mutual fund assumed real rate of return: 5% per year

- Time invested: 25 years (to age 90)

- Withdrawals: Sarah would like to withdraw $1,000 each month to supplement her Social Security benefits

- The mutual fund charges an annual fee of 0.46% if the money is held in the 401(k) plan, but the fee is 0.65% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

|

Mutual fund in 401(k) plan |

Mutual fund in IRA |

|

Annual fee: 0.46% |

Annual fee: 0.65% |

|

Total fees over 25 years: $27,233 |

Total fees over 25 years: $37,091 |

|

Account balance at age 90: $217,553 |

Account balance at age 90: $197,040 |

In summary, rolling over her savings to the mutual fund with the higher fee would result in $20,513 less in savings after 25 years—a significant loss for a person living on a fixed income.

Example 2: Low-cost work plan fund to high-cost IRA fund

Let’s stay with Sarah, who has amassed $250,000 in her employer’s 401(k). Rather than sticking with the same mutual fund when rolling over her savings, Sarah decides to change funds after receiving several marketing pitches and invests in one that was suggested to her. The mutual fund in her 401(k) happens to have particularly low costs at only the 10th percentile of hybrid institutional funds. However, the fund she chooses in the IRA based on the advertisement is higher-cost, at the 90th percentile of hybrid retail funds. Sarah’s new fund’s fees are more than double what they were for the fund in her employer’s plan. Here are some details about her situation:

- Total savings: $250,000

- Mutual fund assumed real rate of return: 5% per year

- With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

- Time invested: 25 years (to age 90)

- Withdrawals: Sarah would like to withdraw $1,000 each month to supplement her Social Security benefits

- The mutual fund charges an annual fee of 0.09% if the money is held in the 401(k) plan, but the fee is 1.44% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

|

Mutual fund in 401(k) plan |

Mutual fund in IRA |

|

Annual fee: 0.09% |

Annual fee: 1.44% |

|

Total fees over 25 years: $5,725 |

Total fees over 25 years: $70,545 |

|

Account balance at age 90: $261,015 |

Account balance at age 90: $123,385 |

In summary, rolling over her savings to the mutual fund with the higher fee would mean $137,630 less in her account balance when she is 90. Because the higher fees erode subsequent gains, the magnitude of the reduction in savings is even more substantial than the magnitude of the fee increase.

Example 3: An Early-Career Job Switcher

Jim is 26 years old and has spent four years in his first job after college. His company offered a 401(k) that included an employer match, allowing Jim to save $30,000 by the time he left for a new position. Because he can no longer contribute to the plan and is unsure how long he will stay at his new job, he decides to roll his 401(k) into an IRA rather than into his new company’s plan. Jim does not have time to research funds, and the mutual fund in which his savings are currently invested has performed well, so he decides to put the assets in the same equity mutual fund. However, the mutual fund fees in the 401(k) plan—at both his old and new jobs—are much lower than in the IRA even though it is the same mutual fund. Jim feels that since he’s only saved a small amount, the difference in fees will not make a big difference to his retirement savings. Here are some details about his situation:

- Total savings: $30,000

- Mutual fund assumed real rate of return: 8% per year

- Time invested: 40 years (to age 66)

- Jim makes no additional contributions to this IRA account. He decides he will leave it until he retires and starts to invest money in his new company’s 401(k) plan once it begins matching contributions.

- The mutual fund charges an annual fee of 0.9% if the money is held in the 401(k) plan, but the fee is 1.24% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

|

Mutual fund in 401(k) plan |

Mutual fund in IRA |

|

Annual fee: 0.9% |

Annual fee: 1.24% |

|

Total fees over 40 years: $61,045 |

Total fees over 40 years: $76,417 |

|

Account balance at age 66: $507,980 |

Account balance at age 66: $443,333 |

Although the difference in total fees paid is somewhat modest ($15,372 over 40 years), these expenses translate into relatively large opportunity costs because they significantly reduce the growth of the account. Rolling over his savings to the mutual fund with the higher fee would reduce Jim’s account balance at retirement in 40 years by $64,647.

What About Revenue Sharing?

Institutional shares are not always cheaper than retail shares. This is especially true when a 401(k) plan offers a share class that pays revenue sharing. The Pew brief doesn’t discuss revenue sharing, but retirement savers should understand how revenue sharing can dramatically increase the cost of a 401(k) plan’s institutional shares.

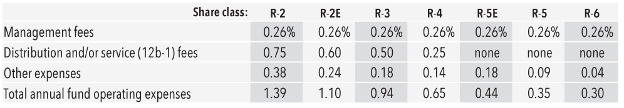

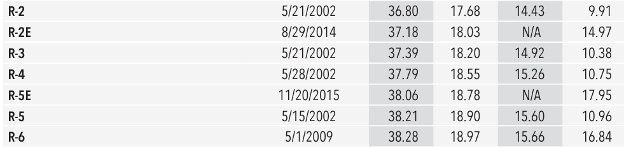

The table below demonstrates this concept. American Funds offers its Growth Fund of America to 401(k) plans in R-shares. R-2 shares pay the highest rate of revenue sharing, while R-6 shares pay none at all. Here’s how these payments affect the expense ratio of each share class:

Here's how the payments affect the returns of these share classes:

Bottom Line – Cost Matters When Saving for Retirement!

Jack Bogle - the founder of the fund company Vanguard – is a hero of mine. I cannot think of another person who has done more to help the average American save for retirement than him. His guiding principle was simple: costs matter. Fees reduce investment returns, so their amount should be kept to a minimum to maximize the power of compound interest over time.

A way to cut fees when saving for retirement with mutual funds is by investing in institutional shares – instead of retail shares – when possible. You’re much more likely to find them in 401(k)s than IRAs. The fees savings can add tens of thousands of dollars to your retirement account. Just watch out for revenue sharing!