According to a National Association of Retirement Plan Participants (NARPP) survey of 4,368 active retirement plan participants, 58% said they didn’t know if they’re paying account fees. Of the participants who know they pay fees, only one in four (26%) could accurately calculate fees. In other words, fewer than 11% could correctly identify and calculate the fees being paid from their accounts.

Given the importance of 401(k) fees, this confusion is a problem, but not at all surprising given the lack of clear fee information available to 401(k) participants today. The DOL finalized a participant fee regulation in 2012, but these rules fell short of full disclosure. Most notably, the amount of “indirect compensation” paid to plan service providers can be hidden inside investment expense ratios instead of explicitly disclosed.

To address the issue of inadequate 401(k) fee disclosure, The Center for American Progress proposed that all 401(k) investments have a clear, understandable label – like the nutrition labels found on our foods - that provides consumers with relevant, concise, and accessible information about fees. They also proposed an easy-to-read annual receipt detailing how much investors spent that year on 401(k) fees. I think these proposals would be more effective in educating investors about 401(k) fees than the DOL’s fee disclosure regulation.

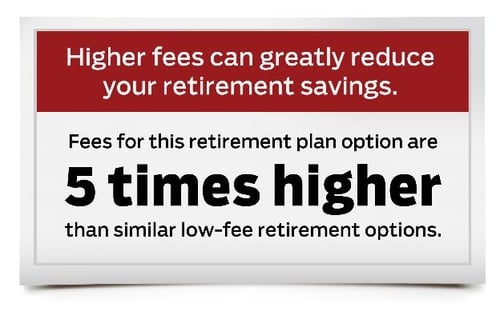

Labels provide a clear warning

Excessive 401(k) fees can take a big bite out of a retirement nest egg. Assuming a 7% investment return, a 1% difference in fees and expenses over 35 years can reduce an account balance at retirement by 28 percent. Since fees can differ dramatically between investments, it’s important for participants to know how much they would pay if they select a particular investment.

In making their case for a label, the Center for American Progress said “Applying the principles that disclosures should be relevant, concise, and accessible, we can imagine a simple “Retirement Fund label.” A Retirement Fund label would be a box visible on all literature, either printed or web-based, that offers a simple disclosure that acts as a sort of hybrid of a cigarette warning and a nutrition label. This label would both inform consumers about the risk of high fees, while offering them a clear and comparable way to think about their fund options.” For example:

According to the NARPP survey, 81 percent of 401(k) plan participants said that a standardized nutrition-style label would be useful in understanding fees.

According to the NARPP survey, 81 percent of 401(k) plan participants said that a standardized nutrition-style label would be useful in understanding fees.

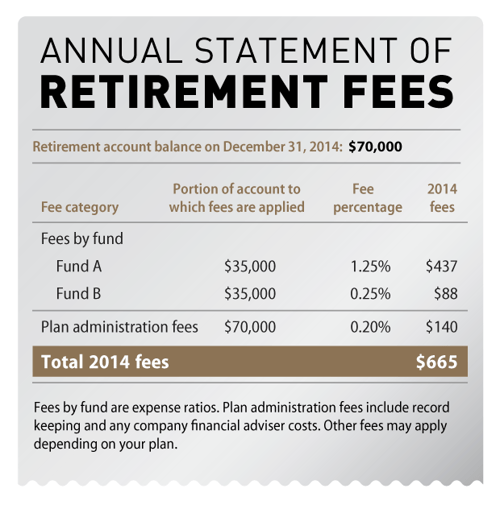

Simple receipts with no technical jargon

Have you reviewed your annual participant fee disclosure to learn how much you might pay in 401(k) fees or quarterly benefit statements to know how much you did pay? Were you able to calculate your fees? Probably not. Annual fee disclosures often contain multiple pages with technical legal jargon and quarterly benefit statements don’t disclose plan fees paid via indirect compensation.

Instead of existing fee disclosures, the Center for American Progress proposed a “simple, easy-to-read annual receipt detailing how much investors spent that year on retirement fees, including both overall plan fees and investment-related fees.”

Pretty simple to understand, don’t you think?

But what about investment performance?

Studies have found low cost funds generally perform better than high-cost funds. In a 2010 article, Morningstar wrote “If there's anything in the whole world of mutual funds that you can take to the bank, it's that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds. Expense ratios are strong predictors of performance. In every asset class over every time period, the cheapest quintile produced higher total returns than the most expensive quintile.”

According to Morningstar, “low-cost funds also produced better risk- and load-adjusted performance as measured by the star rating.”

Fees Matter!

401(k) fees are a drag on participant investment returns. That is why it’s so important for 401(k) investors to understand them. Excessive fees can mean the difference between retiring or working in old age.

Current DOL regulations have not been effective in disclosing 401(k) fees to investors – too many participants don’t know how much they pay. I think simple labels and receipts could do a better job educating participants, helping them maximize investment returns.