Morningstar’s Active/Passive Barometer is a semiannual report that measures the performance of active funds against comparable passive funds (e.g., index funds). You’d be hard-pressed to find a better scorecard in the active vs. passive fund debate. Over the years, the report has found that most active funds underperform their passive counterparts and that higher cost funds are more likely to underperform. I consider the report a must-read for 401(k) fiduciaries.

In my experience, 401(k) fiduciaries often struggle to choose between their active or index fund options when picking investments for their plan. The Active/Passive Barometer can help fiduciaries make an educated choice.

The latest semiannual Active/Passive Barometer was published February 2022. Here’s what I think 401(k) fiduciaries take from it.

Background

Morningstar describes their latest Active/Passive Barometer as follows:

“The Morningstar Active/Passive Barometer is a semiannual report that measures the performance of active funds against passive peers in their respective Morningstar Categories. The U.S. Active/Passive Barometer spans nearly 4,000 unique funds that accounted for ap-proximately $18.7 trillion in assets, or about 67% of the U.S. fund market, as of the end of 2021.

Active/Passive Barometer measures active managers’ success in several unique ways:

- It evaluates active funds against a composite of passive funds. In this way, the “benchmark” reflects the actual, net-of-fees performance of investable passive funds.

- It considers how the average dollar invested in active funds has fared versus the average dollar invested in passive funds.

- It examines trends in active-fund success by fee level.

- It shows the distribution of surviving active funds’ excess returns versus their average passive peer to help investors understand not just the odds of picking a successful manager but also the prospective payout or penalty.

The Active/Passive Barometer is a useful measuring stick that helps investors calibrate the odds of succeeding with active funds in different categories.”

In my view, the latest report offers three key takeaways for 401(k) fiduciaries.

When Evaluating Active and Index Funds, Compare Long-Term Returns

Morningstar found that “Active funds’ short-term success rates are noisy. Their volatility can be influenced by countless factors. Over longer time horizons, there is less noise and the signal regarding active funds’ odds of succeeding is clearer.”

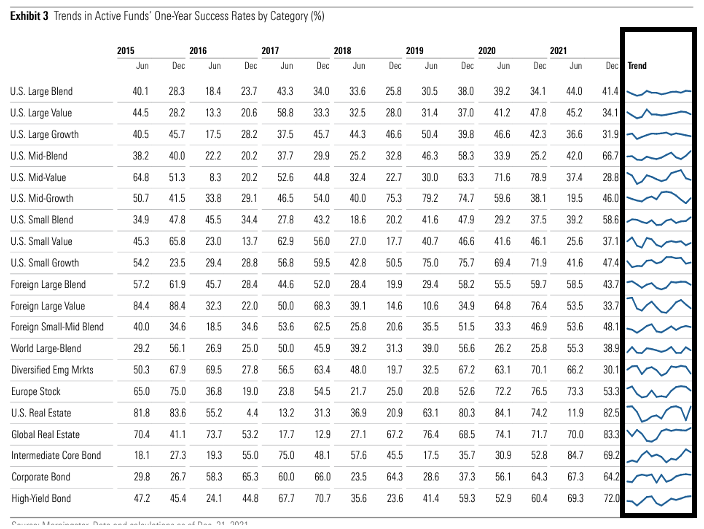

Below are rolling one-year success rates for active funds found by Morningstar.

The takeaway for 401(k) fiduciaries – Compare long-term returns when evaluating active and index funds. Short-term returns are too volatile to identify trends.

The Odds of Outperforming Index Funds Varies by Category

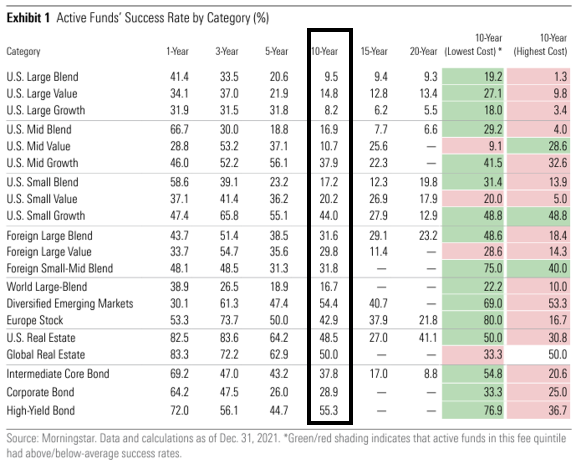

Morningstar found that “In general, actively managed funds have failed to survive and beat their average passive peer, especially over longer time horizons; only 26% of all active funds topped the average of their passive rivals over the 10-year period ended December 2021; long-term success rates were generally higher among foreign-stock, real estate, and bond funds and lowest among U.S. large-cap funds.”

Below is the percentage of active funds that outperformed their passive benchmark over the 10-year period ended December 2021 by fund category.

The takeaway for 401(k) fiduciaries – The odds of picking an active fund that outperforms comparable index funds varies by fund category. The large cap category has the worst odds.

Low-Cost Active Funds are More Likely to Beat Index Funds

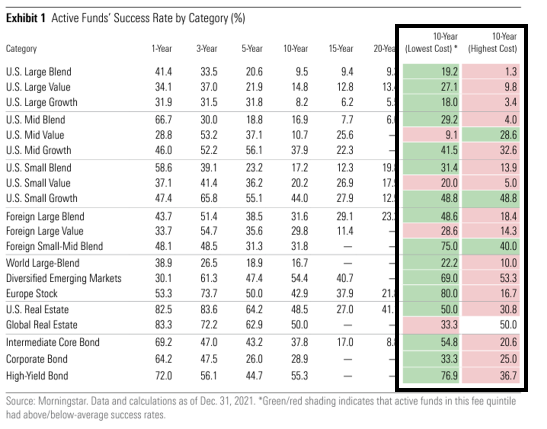

Morningstar found “the cheapest funds succeeded about twice as often as the priciest ones (a 35% success rate versus an 18% success rate) over the 10-year period ended Dec. 31, 2021.”

Below is the percentage of “lowest-cost” and “highest-cost” active funds (based on their fee quintile rank) active funds that outperformed their passive benchmark over the 10-year period ended December 2021 by fund category.

The takeaway for 401(k) fiduciaries – Low-cost active funds are more likely to outperform comparable index funds than high-cost ones. A way to lower the cost of active funds is by picking the lowest-cost share class available.

Picking Active Funds That Beat Index Funds Takes Skill – And Maybe Some Luck!

The Active/Passive Barometer shows it can take a lot of skill – and maybe some luck – to pick active funds that outperform comparable index funds over time, net of fees. When 401(k) fiduciaries understand their odds, many decide not to try. They choose all-index fund line-up lock in cost-efficient market returns for plan participants.

Other 401(k) fiduciaries decide they still want to offer active funds to give participants the chance to earn higher returns. I recommend these fiduciaries hire a fiduciary-grade financial advisor to help tilt the odds of outperforming comparable index funds in their favor.

Want to suggest a blog topic you'd like me to talk about? Click here.