When two or more businesses are members of an affiliated service group (ASG), they are considered a single employer for 401(k) plan purposes. Like the controlled group rules, the ASG rules exist to keep business owners from splitting a business into artificial entities to exclude their low- and middle-income employees from plan participation. When a 401(k) plan excludes the employees of an ASG member, failed coverage testing is often the result. A basic understanding of the ASG rules can help business owners avoid this trouble.

The ASG rules are significantly more complicated than the controlled group rule. As such, an ASG determination from a qualified ERISA attorney is strongly recommended when a business needs clarification about its ASG status. Here are the basics.

What is an Affiliated Service Group?

An affiliated service group (ASG) is two or more entities with a service relationship and, in some cases, an ownership relationship. As described in IRC section 414(m), an ASG can fall into one of three categories:

-

- A-Organization (“A-Org”) group

- B-Organization (“B-Org”) group

- Management group

A 401(k) plan sponsored by one or more members of an ASG must pass coverage testing on an ASG basis (i.e., considering all eligible employees of the ASG).

A-Org Groups

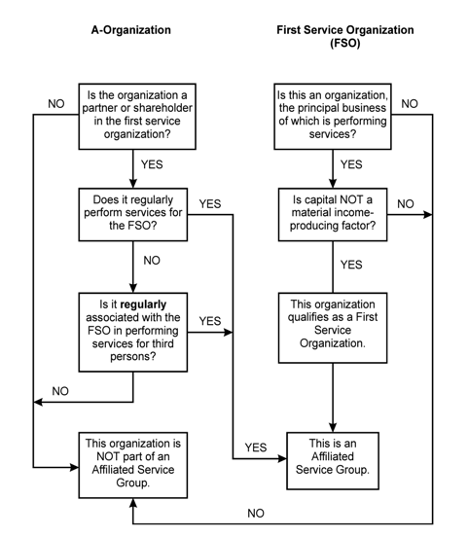

An A-Org group consists of an entity designated as a First Service Organization (FSO) and at least one “A-Org.”

First Service Organization (FSO) Requirements

A first service organization (FSO) must be a “service organization.” Organizations engaged in the following fields are considered service organizations: health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, and insurance fields. Other organizations can also qualify if capital is not a material income producing factor.

Capital is not a material income-producing factor when a business’ income consists principally of fees, commissions or other compensation for personal services performed by an individual.

A FSO can be any entity type (e.g., corporation, partnership, or sole proprietorship).

A-Org Requirements

To be an A-org, an organization must satisfy a two-part test:

-

- Ownership test - the organization must have an ownership interest in the. The IRC section 318 ownership attribution rules must be applied when evaluating ownership, and

- Working relationship test - "regularly performs services for the FSO," or be "regularly associated with the FSO in performing services for third parties.”

A-Org Group Decision Tree

Source: Internal Revenue Service

A-Org Group Example

Emily is an incorporated attorney. Her corporation is a partner in a law firm. Emily’s corporation provides paralegal services for other attorneys in the law firm. Emily’s employees work directly for her corporation, not the law firm.

In this example, Emily’s corporation is an A-Org because it is a partner in the law firm and is regularly associated with the law firm in performing services for third parties.

B-Org Groups

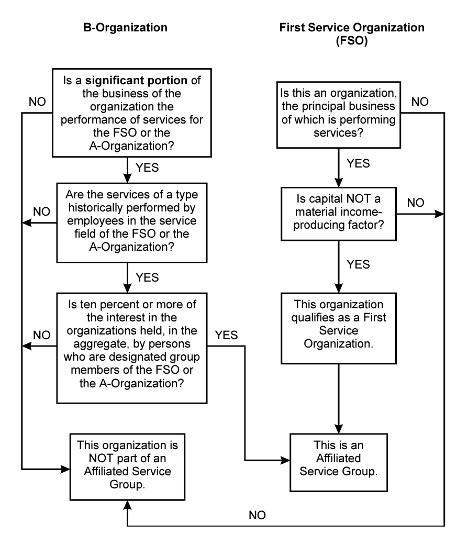

A B-Org group consists of an FSO - or an A-Org related to an FSO - and at least one “B-Org.” The requirements for an FSO are the same for a B-Org group as an A-Org group.

B-Org Requirements

To be a B-Org, an organization must meet the following requirements:

-

- A “significant portion” of its business must be the performance of services for the FSO or related A-Org. A "significant portion" of a B-Org’s business is based on facts and circumstances. The following tests can be used to substantiate the facts and circumstances:

-

- Service receipts safe harbor test

- Total receipts threshold test

-

- The services must be of a type historically performed by employees in the service field of the FSO or related A-Org

- At least 10% of the organization is owned – in aggregate – by “Highly Compensated Employees” of the FSO or related A-Org.

- A “significant portion” of its business must be the performance of services for the FSO or related A-Org. A "significant portion" of a B-Org’s business is based on facts and circumstances. The following tests can be used to substantiate the facts and circumstances:

A B-Org need not be a service organization.

B-Org Group Decision Tree

Source: Internal Revenue Service

B-Org Group Example

ABC Company is a financial services organization with six partners with equal ownership. Each partner of ABC Company also owns 2% of DEF Company. DEF Company provides services to ABC Company of a type historically performed by employees in the financial services field. A significant portion of the business of DEF Company consists of providing services to ABC Company.

In this example, DEF Company a B-Org because:

-

- A significant portion of DEF Company’s business is the performance of services for the ABC Company.

- The services provided by DEF Company are a type historically performed by employees in the financial services field.

- 12% of DEF Company is owned – in aggregate – by Highly-Compensated Employees of ABC Company.

Management Groups

A management-type affiliated service group exists when:

-

- An organization performs “management functions”, and

- The management organization's “principal business” is performing management functions on a “regular and continuing basis” for a “recipient organization.”

There does not need to be any common ownership between the management and recipient organizations.

Management Function Requirements

Management functions must be management activities and services historically performed by employees when determining, implementing, or supervising any of the following:

-

- Daily business operations (such as production, sales, marketing, purchasing, and advertising)

- Personnel (such as staffing, training, supervising, hiring and firing)

- Employee compensation and benefits (such as salaries and wages, paid vacations and holidays, life and health insurance, and pensions)

- Short-range and long-range business planning (such as product development, budgeting, financing, expansion of operations, and capital investment)

- Organizational structure and ownership (such as corporate formation, stock issues, dividends, mergers, and acquisitions)

- Any other management activity or service

Management Group Example

The ABC Company and DEF Company represent a controlled group, while GHI Company and JKL Company represent an A-Org group. ABC performs “management functions” for GHI and these management functions meet the “principal business” on a “regular and continuing basis” tests.

In this example, ABC and DEF are considered a single management organization due to their controlled group status, while GHI and JKL are considered a single recipient organization due to their A-Org status. In short, all four companies - ABC, DEF, GHI, and JKL – represent an ASG.

Not Knowing Your Affiliated Service Group Status Can Be a Costly Mistake!

When a 401(k) plan fails coverage testing, the consequences for the employer can be severe. To correct a failure, plan eligibility must be expanded retroactively to cover more employees. This process often requires the employer to make a Qualified Nonelective Contribution (QNEC) to the new participants. Stiff IRS penalties – including fines and plan disqualification – may also apply.

Excluding the employees of an ASG member is often the cause for failed coverage testing. If you are unsure about your company’s ASG status, consult your 401(k) provider or legal counsel.