When shopping for a new car, the number of variables that can affect a car's price – discounts, trade-in value, taxes, tag fees, dealer prep, etc. - can be frustrating. For most of us, it’s simply easier to ask multiple dealers for their best “all-in” (i.e., out-the-door) price for the car we want. That way, we are not surprised by unexpected fees and can compare any price differences on an apples-to-apples basis.

We recommend 401(k) plan sponsors and participants employ a similar approach when evaluating the reasonableness of their 401(k) provider's administration and investment fees - total them into an “all-in" 401(k) fee and then compare the sum to competing providers and/or industry averages.

This process will differ for 401(k) plan participants and sponsors because each is entitled to different fee information under the law - in general, sponsors must receive more detailed information about "hidden" 401(k) fees such as revenue sharing and variable annuity wraps. Below are the steps involved.

Calculating Your All-In Fee as a Participant

As a plan participant, one of the most important things you can do to make your future retirement as affordable as possible is by paying low 401(k) account fees today. In fact, lowering these fees could add hundreds of thousands of dollars in compound interest to your savings by the time you retire. Not sure how much your 401(k) account pays? Below is a 4-step process for calculating its all-in fee:

1. Find Your 404a-5 Fee Disclosure

This is a document that breaks out all of the fees that you may be subject to in your plan, including plan-level administration fees, investment fees, as well as any individual transaction fees. The Department of Labor requires your employer to send it when you first enroll in the plan, as well as at least once per year thereafter. If you haven’t received one, simply ask your employer or whoever is in charge of your retirement plan.

2. Total Your Administration Fees

The first section of your 404a-5 includes general information about your plan, as well as a description of plan-level fees that may be deducted from your account. Generally, these are all the direct administration fees that cover things like recordkeeping, third-party administration, and custodial services. Add their annual costs to a spreadsheet for later comparison.

3. Total Your Investment Fees

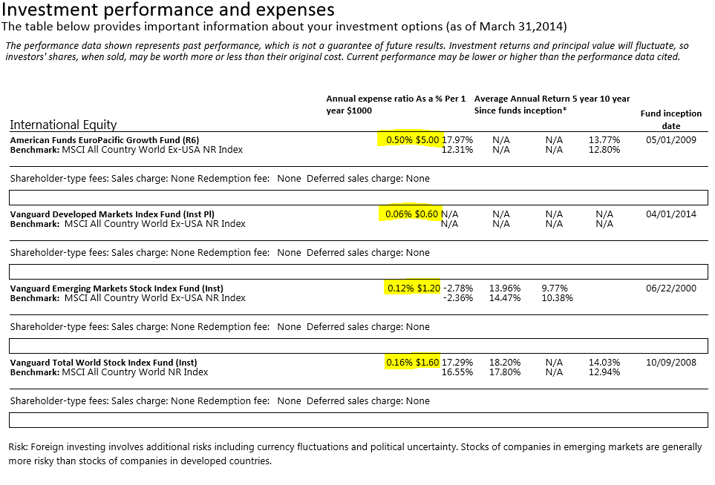

The second section of your 404a-5 includes a comparative chart that shows each fund’s average annual return, expense ratio, shareholder fees, and trade restrictions.

This step is a bit of a pain, but what you’ll want to do is plug each fund’s expense ratio into a spreadsheet. Then, multiply that expense ratio by the dollars you have invested in the fund (you should be able to get this on your monthly or quarterly statement). Add these all up to get your total investment fees.

4. Calculate Your All-In Fee

Now that you have all your administration and investment fees broken out, simply add them all together. If you’d like to see this fee expressed as a percentage of plan assets, divide it by the total dollar amount you have invested in the plan.

Calculating Your All-In Fee as a Plan Sponsor

401(k) providers can be paid fees from three sources today – the plan sponsor (i.e., employer), participant accounts, or plan investments. 401(k) fees paid by the plan sponsor (i.e., employer) or deducted from participant accounts are considered “direct” fees, while 401(k) fees paid by plan investments are considered “indirect” fees. Most 401(k) providers are obligated to disclose their direct and indirect fees in a 408b-2 fee disclosure. To calculate a 401(k) plan's all-in fee, plan sponsors should use their provider's 408b-2 as the starting point.

1. Identify All Plan Service Providers

Your first step is identifying all of your plan's service providers - because they’re not working for free.

All 401(k) plans require three basic administration services - asset custody, participant recordkeeping, and Third-Party Administration (TPA). These necessary services can be delivered by either a “bundled” or “unbundled” provider:

- “Bundled” providers - deliver all three administration services.

- “Unbundled” providers – deliver some, but not all, of them. Most often, an unbundled provider delivers asset custody and participant recordkeeping services - while an unrelated company delivers TPA services.

A financial advisor can be added to a bundled or unbundled provider for professional 401(k) investment advice.

Once you have identified your plan’s service providers, you’re ready to start looking for their fees. A “Covered Service Provider” (CSP) must disclose their fees in a 408b-2 disclosure, while other service providers generally disclose their fees in a services agreement.

2. Determine if your 401(k) Pays "Hidden" Fees

401(k) service providers can be paid fees from three sources today – the employer, participant accounts, or plan investments. 401(k) fees paid by the employer or deducted from participant accounts are considered “direct” fees, while fees paid by plan investments are considered “indirect” fees.

- Direct fees are the most transparent. Their dollar amount must be explicitly reported in 408b-2 and 404a-5 fee disclosures, participant statements, and invoices.

- Indirect fees are a different story. They can be buried in the investment expense ratios of 408b-2 or 404a-5 disclosures, and not appear at all in participant statements or invoices. For these reasons, indirect fees are often called “hidden” 401(k) fees. They come in two basic forms:

- Revenue sharing - Revenue sharing is the practice of adding non-investment related fees to the operating expenses of a mutual fund. These additional fees then compensate a plan service provider. There are two general forms:

- 12b-1 fees – usually compensate a broker or insurance agent.

- Sub-Transfer Agency (sub-TA) fees – usually compensate a recordkeeper.

- “Wrap” fees – Insurance companies often use variable annuities instead of mutual funds as 401(k) investments. A variable annuity is basically a mutual fund wrapped in a thin layer of insurance with additional fees and redemption restrictions. The additional fees usually include a “wrap” fee that can increase the expense ratio of the underlying mutual fund dramatically. Sometimes by more than 1%!

- Revenue sharing - Revenue sharing is the practice of adding non-investment related fees to the operating expenses of a mutual fund. These additional fees then compensate a plan service provider. There are two general forms:

Both direct and indirect fees reduce participant investment returns dollar-for-dollar, so employers have a fiduciary responsibility to keep their total in check.

The problem? Because indirect fees lack the transparency of direct fees, they’re easier to overlook. Their dollar amount is also more difficult to calculate.

3. Add Them All Up to Get Your All-In Fee

At this point, you’re ready to calculate your 401(k) plan’s all-in fee. If your plan pays no indirect fees, you are lucky – this calculation should be a piece of cake. You just need to add the direct fees to your plan’s fund expenses. A spreadsheet can make that job easy.

If your 401(k) plan pays indirect fees, you have more work to do. Using your spreadsheet, you must break out the indirect fees from fund expenses. Service providers that receive indirect fees are almost always considered a CSP – which means they’ll have a 408b-2 disclosure. 408b-2s usually disclose the indirect fees paid by an investment fund as a percentage of assets. To calculate the dollar amount paid by each fund, you must multiply the fund’s current balance by the percentage.

A completed all-in fee calculation for a 401(k) plan that pays both direct and indirect fees can be found here.

Don't Pay Too Much - The Stake Are Too High!

When a 401(k) plan pays excessive fees, participant returns are reduced needlessly - while sponsor liability is increased. This outcome can be easy to avoid when plan participants and sponsors know how to calculate their all-in 401(k) fee.