Bar none, profit sharing contributions are the most flexible type of employer contribution a company can make to their 401(k) plan. These contributions are not only discretionary, but they can be made to any eligible plan participant – even if the participant fails to make 401(k) deferrals themselves. They can also be allocated using dramatically different formulas – allowing employers to meet a broad range of 401(k) plan goals with them.

Yet, despite their flexibility, profit sharing contributions are not a good choice for every 401(k) plan. Matching contributions can be more effective in meeting certain 401(k) plan goals. Further, not all employers will qualify for the most flexible types of profit sharing due to IRS nondiscrimination test limitations. If you’re a 401(k) plan sponsor, you want to understand your company’s profit sharing contribution options. To meet certain 401(k) goals, they can be tough to beat.

Profit sharing contribution basics

401(k) profit sharing contributions are a type of “nonelective” employer contribution. That means employees do not need to make 401(k) deferrals themselves to receive them. In contrast to safe harbor nonelective contributions, profit sharing contributions are discretionary – which means you don’t have to make them every year.

Profit sharing contributions can also be made subject to a vesting schedule – up to 3-year cliff or 6-year graded. This can be handy if you have short-tenured employees because they’ll be required to forfeit some or all of their profit sharing account upon a separation from service.

When to choose profit sharing contributions

Because profit sharing contributions are flexible, they can be a great choice if your company is a start-up, has erratic profitability, or acquires other companies frequently. If your company is more stable, these contributions can help you meet several 401(k) plan goals, including:

- Increasing the contributions made to 401(k) participant accounts up to the legal limit ($70,000 for 2025, not including 401(k) catch-up deferrals).

- Giving low-earners a base retirement benefit.

- Attracting top employee talent with a generous retirement benefit.

However, not all 401(k) plan goals are best served by profit sharing contributions. Employer matching contributions are generally the superior choice if a primary 401(k) plan goal is incentivizing your employees to save for retirement themselves.

The 3 most common profit sharing allocation formulas

Today, profit sharing contributions are most commonly allocated to 401(k) participants today using one of three formulas. These allocation formulas vary in complexity and can be used to meet dramatically different plan goals.

Pro rata

This formula is the most basic. With a pro rata allocation, all eligible participants receive the same contribution rate (a contribution’s dollar amount divided by the participant’s compensation).

A pro rata formula can be a great choice if you want to provide an easy-to-understand retirement benefit to employees or a retirement benefit floor. These allocations are deemed to automatically pass IRS nondiscrimination testing.

Permitted disparity

Permitted disparity allocation formulas are more complicated. They’re designed to favor employees with high incomes. Basically, they involve two pro rata allocations to employees – one based on their total compensation and another on any compensation earned above the plan’s “integration level” (i.e., excess compensation). The integration level is either the Security Taxable Wage Base (SSTWB) in effect for the year or some portion of it.

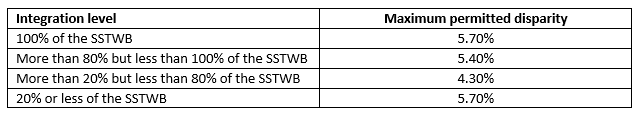

The contribution rate applied to excess compensation cannot exceed the lesser of 1) the contribution rate applied to total compensation or 2) the maximum “permitted disparity” percentage – which is based on the plan’s integration level:

Example – In 2023, an employer makes a permitted disparity profit sharing contribution. Their plan’s integration level is 100% of the SSTWB ($160,200). Business Owner A earns $200,000. If the employer makes a 10% contribution on total compensation, Business Owner A would receive a $22,268.60 allocation.

| Employee |

(a) Total Compensation |

(b) Contribution Rate |

(c) Excess Comp |

(d) Excess Rate |

(a*b)+(c*d) Total Allocation |

| Owner A | $200,000 | 10% | $39,800 | 5.70% | $22,268.60 |

You should consider a permitted disparity formula if you want to give greater contribution rate to high income employees while still passing IRS nondiscrimination testing automatically.

New Comparability

New comparability is the most flexible type of profit sharing allocation formula. It allows an employer to allocate multiple contribution rates to different employee groups – or even a different contribution rate to each employee. Most employers use this flexibility to allocate larger contribution rates to business owners, or other Highly-Compensated Employees (HCEs).

However, to qualify for this flexibility, new comparability allocations must pass a complicated IRS nondiscrimination test (called the “general test”) to prove they don’t discriminate in favor of HCEs. Most allocations pass the general test by converting participant contribution rates to a benefit rate at retirement - typically, age 65. This “cross-testing” can make a 15% contribution to a 55-year-old (with 10 years to retirement) as valuable as a 5% contribution to a 30-year-old (with 35 years to retirement) for testing purposes.

Due to “cross-testing,” companies with older business owners are typically the best candidates for new comparability contributions. A spread of 10+ years often does the trick, allowing an employer to maximize owner contributions while allocating just the “gateway minimum” contribution to non-HCEs. The gateway minimum contribution made to all plan non-HCEs must equal the lesser of:

- one-third the highest contribution rate given to any HCE (based on the plan’s definition of compensation)

- 5% of the participant’s gross compensation

If one of your primary 401(k) plan goals is maximizing business owner contributions at the lowest total cost, a new comparability formula can be your best bet. However, due to the general test, this allocation formula may not be available to your company if young HCEs are employed.

Profit sharing contributions can help you meet your 401(k) goals at the lowest cost!

Because of their flexibility, profit sharing contributions can be used to meet a broad range of 401(k) plan goals. You should understand their allocation options to decide if one can help your company meet its unique 401(k) plan goals.

You should also understand how these contributions can be combined with other employer contribution types – like safe harbor contributions. These combinations can help your 401(k) plan pass annual IRS nondiscrimination testing in addition to meeting your company’s goals. To see some of the popular combinations used today, check out our 2022 plan design study.