The U.S. Government Accountability Office (GAO) is federal agency that, according to its website, “provides Congress and federal agencies with objective, non-partisan, fact-based information to help the government save money and work more efficiently.” In an August report, the GAO assessed the effectiveness of the Department of Labor’s (DOL) 401(k) fee disclosure rules. They found that nearly 40% of 401(k) plan participants do not understand the fee information mandated by the DOL. This much confusion is a big problem when you consider the cumulative effect of 401(k) fees over time. To manage these losses, participants need a clear understanding of their 401(k) fees.

In their report, the GAO recommended five ways for the DOL to help participants better understand their 401(k) fees. Here’s a summary of what the GAO found and their recommendations to the DOL.

Background

The DOL’s 401(k) fee disclosure regulation took effect in 2012. The regulation is intended to “to ensure that all participants have the information they need to make informed decisions about managing their accounts and investing their retirement savings.”

To comply with the DOL regulation, 401(k) plans must disclose their administrative and individual fees to participants on or before the date they can make investment choices and on an ongoing basis. They must also inform participants of the administrative and individual fees deducted from their account at least quarterly.

What the GAO Found

For its report, the GAO “asked participants a series of questions based on actual disclosure content drawn from among 10 of the largest 401(k) plans, as well as questions about related concepts, to assess participants’ understanding of administrative and investment fee information illustrative of what plans are required to provide to participants (test questions).”

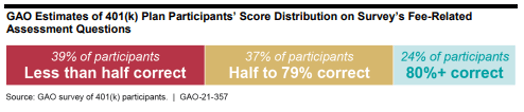

The GAO found “almost 40 percent of 401(k) plan participants do not fully understand and have difficulty using the fee information that the Department of Labor (DOL) requires plans to provide to participants in fee disclosures.”

They also found:

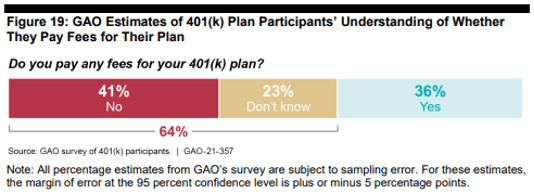

- 64 percent of participants believe they are either not paying any 401(k) fees—administrative or investment fees—or do not know if they are paying these fees.

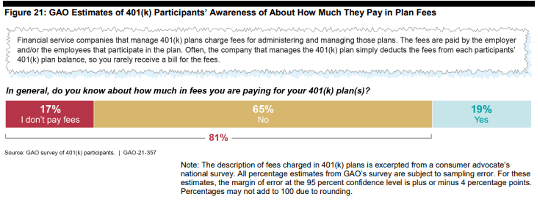

- 81 percent of participants do not know approximately how much they pay in fees or incorrectly believe that they do not pay fees at all.

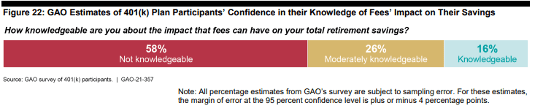

- 58 percent of participants believe that they are not knowledgeable about the impact fees can have on their total retirement savings.

GAO Recommendations

It’s tough to overstate how much cost matters when saving for retirement. 401(k) fees can cost a participant hundreds of thousands in lost principal and compound interest by the time they retire. To help participants manage these losses, 401(k) fee disclosures must be clear as possible. The GAO recommended five ways the DOL can improve the effectiveness of their fee disclosure regulation:

- Require, in a manner deemed effective, that fee disclosures for participant-directed individual retirement accounts use a consistent term for asset-based investment fees (e.g., gross expense ratio).

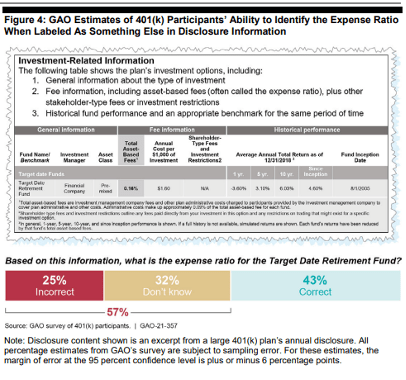

Reason: DOL regulations do not specify how to label investment fees, which can make it difficult for participants to identify and compare costs. For example, the GAO “found that participants have a difficult time identifying an investment’s expense ratio when the fee is labeled differently, which DOL’s regulation does not prohibit.”

- Require, in a manner deemed effective, that quarterly fee disclosures for participant-directed individual retirement accounts provide participants the actual cost of asset-based investment fees paid.

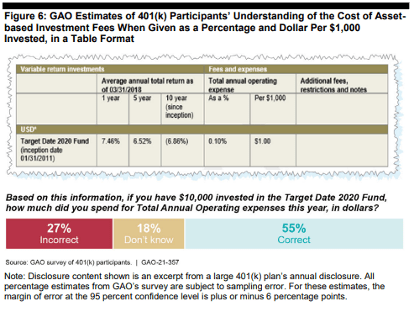

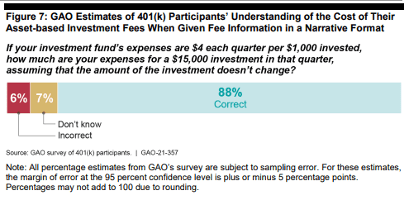

Reason: DOL does not require plans to provide participants with the actual cost of their asset-based investment fees. In their report, the GAO estimates that 55 percent of participants can correctly calculate their asset-based investment fees based on the table format used in today’s fee disclosures. However, this number jumps to 88 percent when fees are shown in narrative form.

vs:

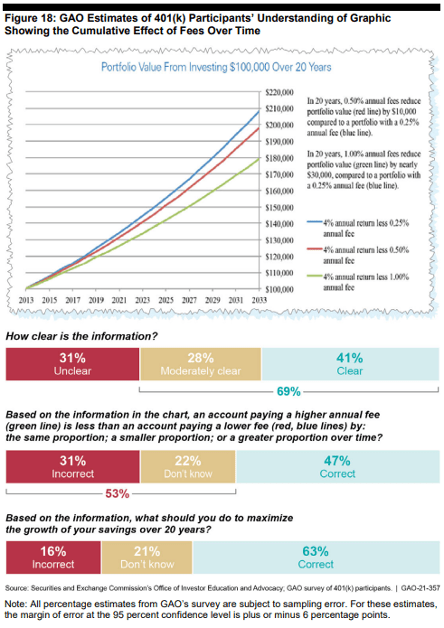

- Take steps to provide participants important information concerning the cumulative effect of fees on savings over time. For example, steps could include ensuring disclosures cite a working, specific DOL web address for where such information is shown and requiring that fee disclosures include the agency’s graphic illustration on the cumulative effect of fees.

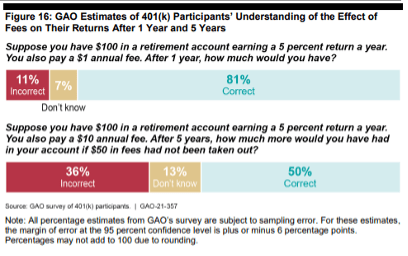

Reason: The GAO found that DOL materials about the cumulative effects of 401(k) fees was too hard for participants to find and that most participants could not calculate the value of missed returns – which compound over time - when 401(k) fees are deducted from their account.

Even worse, only 63 percent of participants understood they should choose investments with lower fees to maximize the growth of their savings.

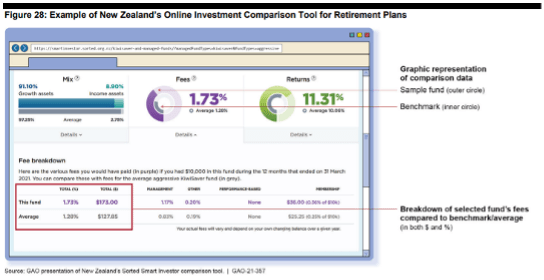

- Require, in a manner deemed effective, that participant fee disclosures for participant-directed individual retirement accounts include fee benchmarks for in-plan investment options.

Reason: Fee benchmarks can help participants to assess an investment option’s value, not only relative to other in- plan options but to options outside the plan. Stakeholders in Australia, Italy, New Zealand, and the EU stated that fee benchmarks help participants compare investment options. For example, New Zealand’s government calculates fee benchmarks for different fund categories that reflect a range of investment strategies.

- Require, in a manner deemed effective, that participant fee disclosures for participant-directed individual retirement accounts include ticker information for in-plan investment options, when available.

Reason: Ticker symbols are a unique identifier available for many types of investments, including mutual funds, and can help participants compare their investment fees by making it easier to identify their investments for research and evaluation outside of their plan. Without ticker information for plan investment options, a participant may not be able to identify the correct fund, which means they may not have correct information on investment fees as costs often vary with share class.

But What About Hidden 401(k) Fees?

In general, I support all five of the GAO recommendations. However, I don’t think they go far enough to address the jaw-dropping level of 401(k) fee confusion the agency found.

My recommendation? Mandate the break out of revenue sharing, wrap fees, and sales loads from the operating expenses of plan investments in annual fee disclosures. These hidden fees are indisputably the top reason why “81 percent of participants do not know approximately how much they pay in fees or incorrectly believe that they do not pay fees at all” in my view. Better yet? Ban them altogether.