The ideal 401(k) plan helps employees and employers meet their respective goals at the lowest cost. In our experience, the features of such plans are not widely understood by employers. A big reason why is the cacophony of plan services, investments, and fees offered by 401(k) providers today. This noise helps conflicted 401(k) providers sell overpriced services and investments that put profit ahead of client interests. Employers can avoid this trap by understanding the features of an ideal 401(k) plan.

When a 401(k) plan is ideal, employees retire richer and employers avoid undue costs. The features that drive these benefits are not hard to understand. Here’s what employers need to know.

The Ideal 401(k) Plan for Employees

To make retirement as affordable as possible, employees must avoid three 401(k) pitfalls while saving throughout their working years - excessive fees, underperforming funds, and inappropriate asset allocation.

- Excessive fees– Fees lower the 401(k) account returns dollar-for-dollar. Excessive fees reduce them unnecessarily.

- Underperforming investments– underperforming 401(k) investments are active funds that underperform comparable index funds over time, net-of-fees.

- Inappropriate asset allocation– Not maintaining an appropriate asset allocation over the years can cost a 401(k) participant gains when young or unrecoverable losses when older.

Avoiding these pitfalls can add hundreds of thousands of dollars in compound interest to a 401(k) account over decades of saving. The ideal 401(k) plan incorporates three features that can make them easy to avoid:

- No hidden fees– “Hidden” fees are paid to 401(k) providers by investment fund companies. They increase the cost of 401(k) investments – lowering their returns. The two most common forms are revenue sharing and variable annuity wraps. The ideal 401(k) plan pays no hidden fees to help participants avoid excessive fees.

- Cost-efficient investments– Studies show most active funds underperform comparable index funds. A major reason why is cost. Active funds can cost several times more than comparable index funds from leading providers such as Vanguard, Schwab, or Fidelity. Most fail to offset this handicap with higher returns. The ideal 401(k) plan offers low-cost index funds - or active funds that deliver no less, net of fees – to help participants avoid underperforming funds.

- Professional advice– Most 401(k) plans offer some form of professional investment advice to help participants establish and maintain an appropriate asset allocation. Of these forms, I consider target date index funds (TDIFs) to be the gold standard due to their cost-efficiency. A TDIF can cost less than 0.10% of assets per year. In return, participants get a professionally managed mix of low-cost index funds. The ideal 401(k) plan offers TDIFs - or another form of advice that delivers no less, net of fees – so participants do not overpay for appropriate asset allocation.

The Ideal 401(k) Plan for Employers

Employers can have dramatically different goals for a 401(k) plan. Some want to maximize the annual contributions allocated to business owners, while others want to incentivize employee contributions. The process of matching 401(k) options to employer goals is called plan design.

Proper 401(k) plan design can mean big savings for employers. It’s not uncommon for an employer to save tens of thousands of dollars in annual contribution expenses by choosing one design over another while still meeting their plan goals. Proper plan design can also help employers avoid nondiscrimination test failures.

The ideal 401(k) plan for an employer is designed to meet plan goals at the lowest cost.

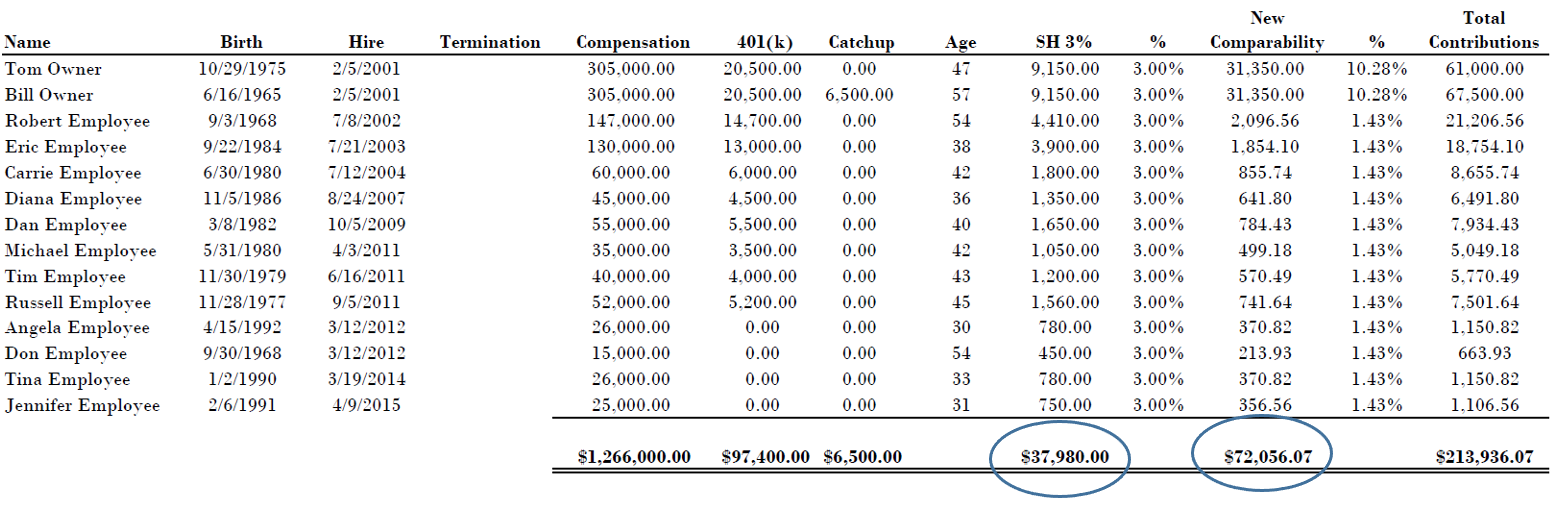

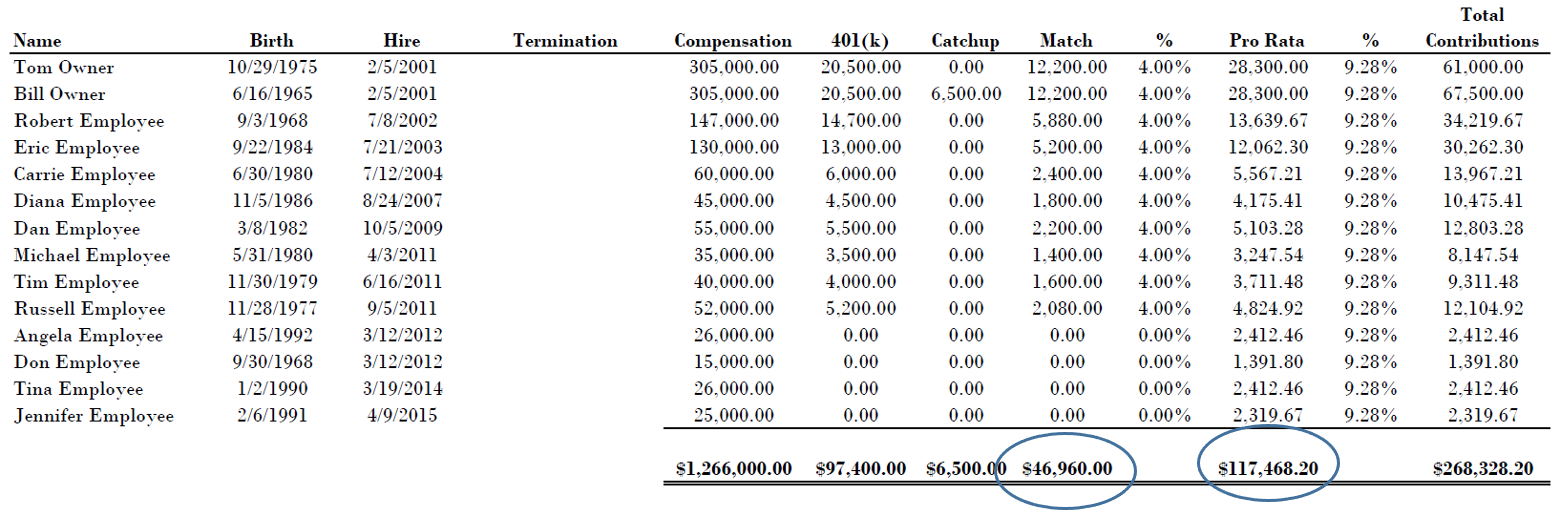

Below is an example of the savings possible with proper plan design. The goal for this hypothetical 14-participant plan is maximizing the annual contributions of business owners. To meet this goal, plan design #1 would cost the employer $110,036.07, while plan design #2 would cost $164,428.20. By choosing design #1 over design #2, the employer would save $54,392.13 annually!

Plan design #1 – Safe harbor 401(k) plan + new comparability profit sharing contribution

Plan design #2 - Traditional 401(k) plan + discretionary match + pro rata profit sharing contribution

Cost isn’t the only problem with plan design #2. Because the design doesn’t not meet safe harbor 401(k) standards, the employee and matching contributions would be subject to annual ADP/ACP testing. When a plan fails this nondiscrimination testing, the fix usually involves refunding the excess contributions made by Highly-Compensated Employees. These refunds can make it impossible for owners to maximize their annual contributions up to the legal limit.

Understanding the Ideal 401(k) Plan is the Easy Part!

Overpriced 401(k) plans force employees to work longer than necessary to afford retirement and employers to bear unnecessary expense. Understanding the features of an ideal 401(k) plan can help employers avoid these pitfalls.

These features are not hard to understand. They boil down to cost-efficient returns for employees and custom plan design for employers. A much harder job is finding a 401(k) provider willing to deliver the ideal 401(k) plan. An overpriced plan can be much more lucrative.

Want to suggest a blog topic you'd like me to talk about? Click here.