Critics of the DOL’s proposed fiduciary rule, also known as the "conflict of interest rule for investment advice," argue that the rule will make investment advice too costly for many 401(k) plans. If the critics are right, this issue would be a compelling reason to scuttle the rule – studies have shown that professional advice can help 401(k) participants increase investment returns. An Aon Hewitt study found that median investment returns for 401(k) participants using target-date funds, managed accounts and other investment advice were 3.32% greater than returns earned by participants that picked investments themselves.

Fortunately, this concern can be easily rebutted – there are 401(k) financial advisors subject to a fiduciary standard today. Compare their fees – the data are out there - to fees charged by non-fiduciary brokers and insurance agents. Bottom line, fiduciaries already complying with underlying standards compare favorably with industry averages for non-fiduciaries. Rule changes will allow more low-cost competition to flourish.

Show me the data!

As a 401(k) recordkeeper, our firm works with hundreds of financial advisors nationwide. All of these advisors are fiduciaries under the Investment Advisers Act of 1940. That makes these advisors fiduciaries for their 401(k) plan clients under ERISA. As ERISA fiduciaries, these advisors are required to deliver conflict-free advice to their 401k clients.

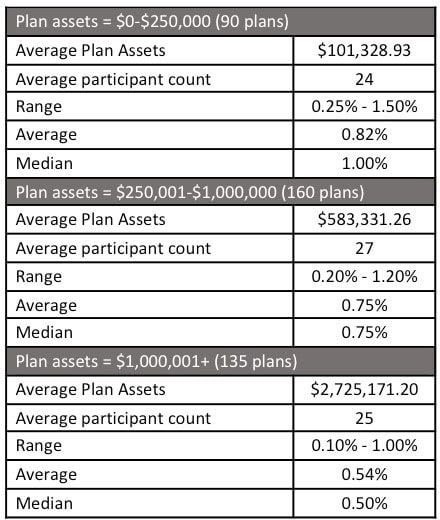

In August of 2014, our firm completed a study where investment advisor fees for 385 plans that pay advisor fees from plan assets were evaluated. The following table summarizes the findings of our study:

Comparing advisor fees within the context of a “bundled” arrangement

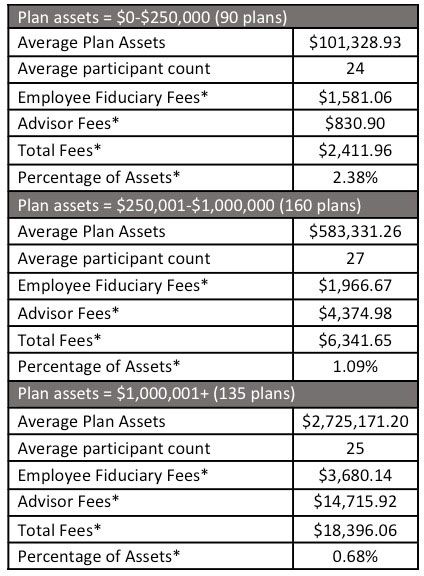

Employee Fiduciary provides custody, recordkeeping, and administration (plan document, testing, Form 5500) to 401(k) plans. Financial advisors ally with service providers like Employee Fiduciary to deliver “bundled” (complete) 401(k) solutions to plan sponsors. When evaluating financial advisor fees, sponsors should do so within the context of the total fees charged under the bundled arrangement. By adding financial advisor fees from the prior table to Employee Fiduciary fees, average total plan fees can be determined.

*Based on average plan assets and participant count.

These figures do not include investment expense ratios. That said, most of the financial advisors that partner with Employee Fiduciary use low cost investments like index funds and ETFs in their menus.

How do these fees compare with the 401k industry?

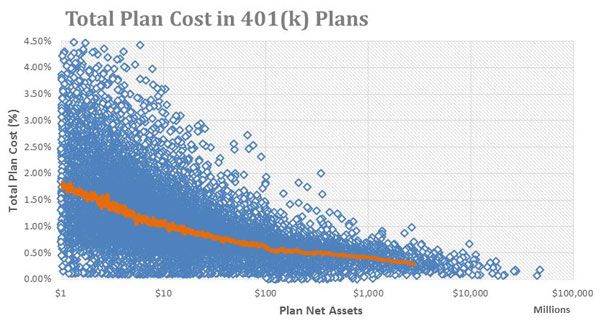

BrightScope is a leading provider of retirement plan ratings and investment analytics to participants, plan sponsors, asset managers, and advisors. Earlier this year, they released the following chart that summarizes 401(k) fee information from their database:

While plans under $1M are not represented by this chart, you can see the glide path for 401(k) fees and that plans that use a fiduciary-grade financial advisor do not pay more. In fact, most often, they pay less.

Don’t let the unfounded rhetoric of opponents go unanswered

A fiduciary rule would be an important victory for 401(k) investors. According to a White House Council of Economic Advisers analysis, conflicts of interest cost retirement plan investors $17 billion per year. That’s a lot of money! These savings can mean the difference between being able to afford retirement or not.

While I don’t view the DOL’s proposed rule as perfect – I would prefer a clean rule with fewer carve-outs – it’s still an important step towards eliminating the conflicts of interest that rob 401(k) participants of investment returns. I hope the DOL rule becomes final without any further dilution. While opponents will spend a lot of money to stop a final rule, their arguments wither under scrutiny. That’s the key advantage for advocates – we’ve got the facts on our side. We just need to show the data.