Not all 401(k) plans are created equal. Plans with minimal administration fees and top-rated investments can deliver dramatically higher returns for participants than plans with excessive fees and underperforming investments. Over time, these higher returns can help participants retire years sooner. Given the stakes, I recommend you settle for no less when saving for retirement.

The problem? Plan fiduciaries at your company control your 401(k) administration fees and investments - not you. That means you must successfully lobby one to improve them on behalf of you and other plan participants.

The good news? 401(k) plan fiduciaries are often receptive to this lobbying for two reasons – fear of fiduciary liability and a personal financial stake in higher returns as plan participants themselves.

However, to successfully lobby many plan fiduciaries, you should be prepared to demonstrate to them the benefit of better 401(k) fees and investments. Here is how I would do that.

Step 1 – Understand the 401(k) Pitfalls That Lower Participant Returns

To retire as soon as possible, you must avoid three 401(k) pitfalls that will needlessly lower your investment returns during your working years - excessive administration fees, underperforming funds, and inappropriate asset allocation.

- Excessive administration fees – administration fees compensate a 401(k) provider for delivering plan services such as asset custody, participant recordkeeping, Third-Party Administration (TPA), and professional investment advice. When these fees are paid from plan assets, the portion paid by your account will reduce your investment returns dollar-for-dollar. Excessive fees will reduce your returns needlessly.

- Underperforming funds – 401(k) investments come in two basic types – active funds and index funds. Active funds try to outperform their market benchmark (e.g., S&P 500), while index funds try to match the returns of their benchmark. Ironically, most actively funds actually underperform “comparable” index funds (basically, funds with a similar benchmark) over time, net of fees. Underperforming active funds will lower your investment returns needlessly.

- Inappropriate asset allocation – Asset allocation is an investment strategy that aims to balance risk and reward by allocating an investment portfolio among different asset categories - such as stocks, bonds, and cash. Striking an appropriate balance when 401(k) investing is important. Otherwise, you could miss out on gains by investing too conservatively when young or sustain unrecoverable losses by investing too aggressively when near retirement.

You can avoid inappropriate asset allocation by investing in a Target-Date Fund (TDF) or utilizing some other form of professional investment advice offered by your plan. However, only plan fiduciaries can remove excessive administration fees and underperforming investments. Here’s how I would make a case for better alternatives.

Step 2 – Show How Lower Admin Fees Will Grow Participant Balances

401(k) administration fees can be “direct” and “indirect” in nature. The difference is how they are paid. Direct fees are deducted from your account, while indirect fees increase the cost of your investments – lowering their returns. The two most common forms of indirect fees are revenue sharing and variable annuity “wraps.”

Both direct and indirect administration fees will ultimately reduce your 401(k) investment returns dollar-for-dollar. However, that’s not the most insidious part about them. Once they leave your account, their amount can no longer earn compound interest. That means you won’t just miss out on their principal in retirement – you’ll also miss out on their future earnings.

To avoid these losses altogether, you want plan fiduciaries to pay 401(k) administration from a bank account, not plan assets. This approach can be a win-win for you and business owners. You can keep their amount invested, while business owners can deduct them as a business expense – or better yet, claim a tax credit for them. To eliminate indirect fees from your investments, plan fiduciaries must replace their share class with a lower-cost one that pays none.

The following table demonstrates the importance of keeping 401(k) administration fees to a minimum. It shows the erosive effect of annual fees on a 401(k) balance over time. Table assumes $20,000 in annual contributions and a 7% rate of return (compounded daily).

|

10 Years |

20 Years |

30 Years |

40 Years |

|

|

No Annual Fees |

||||

|

Account Balance |

289,660.56 |

872,926.14 |

2,047,399.97 |

4,412,341.08 |

|

0.50% Annual Fee |

||||

|

Account Balance |

281,720.92 |

821,337.63 |

1,854,935.64 |

3,834,720.26 |

|

Loss due to fees |

(7,939.64) |

(51,588.51) |

(192,464.33) |

(577,620.82) |

|

1% Annual Fee |

||||

|

Account Balance |

274,054.69 |

773,390.28 |

1,683,194.18 |

3,340,883.23 |

|

Loss due to fees |

(15,605.87) |

(99,535.86) |

(364,205.79) |

(1,071,457.85) |

|

2% Annual Fee |

||||

|

Account Balance |

259,501.47 |

687,332.41 |

1,392,682.23 |

2,555,567.65 |

|

Loss due to fees |

(30,159.09) |

(185,593.73) |

(654,717.74) |

(1,856,773.43) |

Step 3 – Show How New Investments Will Increase Participant Returns

It’s tough to beat the investment returns of low-cost index funds from leading providers such as Vanguard, Fidelity, or Schwab. In fact, most active funds don’t over time, net of fees. If your plan includes underperforming active funds, you want them replaced to increase your investment returns.

To successfully lobby plan fiduciaries to replace underperforming funds, I recommend you demonstrate how much more you and other plan participants could have earned with index funds. Morningstar offers a no-cost fund comparison tool that can help you do that using a spreadsheet.

Here are the steps to take for each underperforming fund.

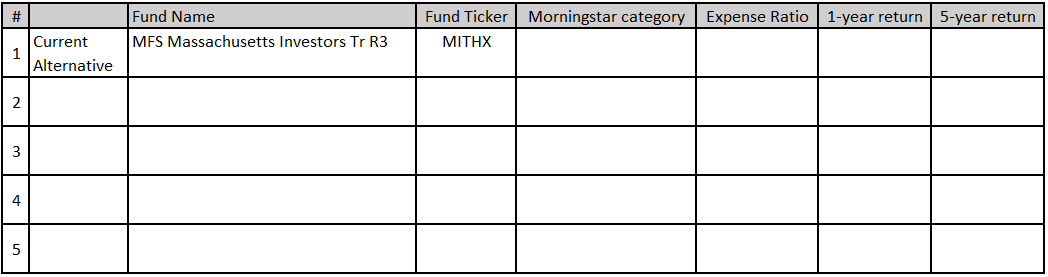

1. Enter the name and ticker symbol of the current fund into your spreadsheet.

2. In the Fund Compare tool, enter the ticker symbol into the “Enter tickers” box.

Click the “Add to List” button and then click the “Show Comparison” button. From the Snapshot view, enter the fund’s Expense Ratio and Morningstar Category into your spreadsheet. I will the MFS Massachusetts Investors Tr R3 fund (Ticker = MITHX) as an example.

Choose the performance view. Enter the 1-year Return(%) and 5-year Return (%) into your spreadsheet.

3. Return to the Edit Funds page.

Click on the Fund Comparison Ideas hyperlink. Check the appropriate Morningstar Category box on the resulting pop-up.

Hit the Submit button to return to the Edit Funds page.

4. On the Edit Funds page, hit the Show Comparison button

5. Sort the results page by Expense Ratio so the lowest expensive ratios display first. To find an index fund, look for the word “index” in the fund name.

Select a fund for comparison by clicking its hyperlink. I will use the Vanguard 500 Index Admiral fund (Ticker = VFIAX) as an example.

Enter the name of the fund, its ticker and expense ratio into your spreadsheet.

6. Compare the returns.

|

|

Fund Name |

Fund Ticker |

Morningstar category |

Expense Ratio |

1-year return |

5-year return |

|

Current Fund |

MFS Massachusetts Investors Tr R3 |

MITHX |

Large Blend |

0.71% |

0.35% |

7.98% |

|

Alternative Fund |

Vanguard 500 Index Admiral |

VFIAX |

0.04% |

1.91% |

8.82% |

In the example, we found the 5-year average return of the VFIAX fund was 0.84% higher (8.82% - 7.98%) than the more expensive MITHX fund. The MITHX fund pays 0.25% of assets in revenue sharing, but the amount does not fully account for the fund’s return deficit.

Lobbying 401(k) Plan Fiduciaries Doesn’t Need to be Adversarial!

The 401(k) plan fiduciaries at your company have a legal duty to protect your interests by paying only “reasonable” administration fees from plan assets and picking “prudent” investments – basically funds that meet their investment objective for “reasonable” fees. However, meeting this important fiduciary responsibility can be easier said than done given the conflicted investment advice they can receive from your 401(k) provider.

Don’t let your 401(k) provider get away with it! Think your administration fees and investments can be improved? Do some research, identify some improvements, and then make your case to plan fiduciaries. There’s a good chance they will appreciate your initiative – particularly when their own investment returns are on the line.