High 401(k) fees are a big problem. Over the course of many years of investing, these fees can cost you tens – even hundreds – of thousands of dollars thanks to the power of compound interest.

If you’ve calculated your 401(k) fees and found them to be excessive, your next step is to lower them. Whether you’re responsible for your company’s 401(k) plan (i.e., the plan sponsor), or a participant concerned about your own account, we’ve broken down everything you can do to lower your fees in this guide.

How to Lower Your 401(k) Fees as a Plan Sponsor

1) Check for Lower-Cost Share Classes

Mutual fund companies usually make their funds available to 401(k) plans in multiple share classes. While all classes hold the same underlying securities, they can charge very different fees. Generally, employers have a fiduciary responsibility to choose the lowest-priced share class available to their 401(k) plan – so avoidable investment fees don’t reduce participant returns needlessly.

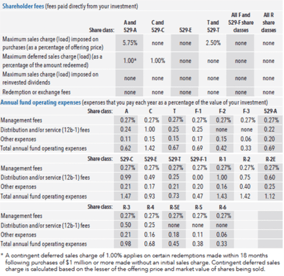

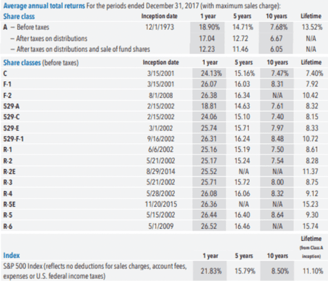

To see how different share classes affect investment returns, check out the following two tables from an American Funds Growth Fund of America prospectus. The first table shows the different fees charged by the fund’s share classes, while the second one discloses their investment returns over specific periods of time.

401(k) plans most commonly use one of the fund’s eight “R” share classes. Each of these classes pay a different amount of revenue sharing - with R-1 shares pay the most, while R-6 shares pay none at all. For this fund, the R-6 shares returned 1.27% more on average annually over the past 5 years than R-1 shares. That’s a lot!

If you believe you can qualify for better share classes, talk to your 401(k) provider to see what you can do.

2) Replace Your Funds with Lower-Cost Alternatives

Morningstar provides a free tool that allows you to compare the fees and returns of comparable funds (i.e., funds within the same Morningstar market category). Using this tool can help you identify lower-cost alternatives to your current funds.

If you’re not sure where to start, I recommend comparing your funds to passively-managed index funds from leading providers such as Vanguard, Fidelity, or Schwab. These funds charge low fees for market-correlated returns. They’re also likely to outperform comparable actively-managed funds (i.e., funds with similar holdings) over time, net of fees charged.

To evaluate fund alternatives using the Morningstar tool, take the following steps.

- Enter the fund name and ticker symbol into a spreadsheet

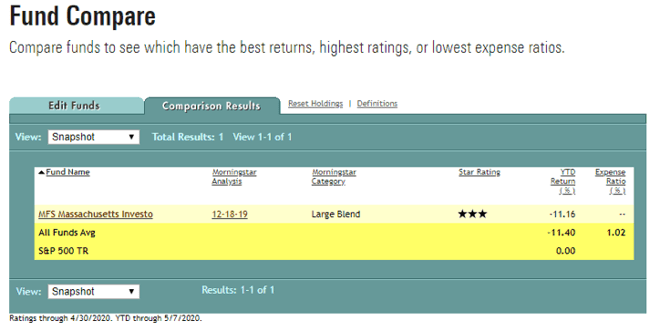

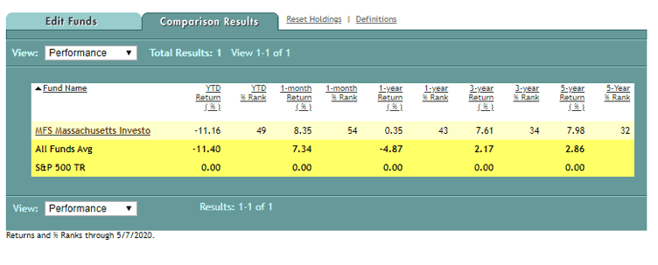

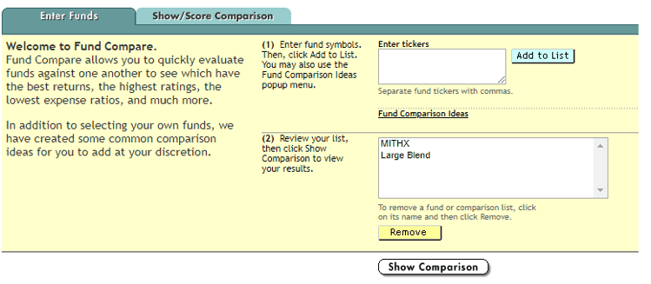

- In the Fund Compare tool, enter the ticker symbol into the “Enter tickers” box. Click the “Add to List” button and then click the “Show Comparison” button. From the Snapshot view, enter the fund’s Expense Ratio and Morningstar Category into your spreadsheet. I will the MFS Massachusetts Investors Tr R3 fund (Ticker = MITHX) as an example.

Choose the performance view. Enter the 1-year Return(%) and 5-year Return (%) into your spreadsheet.

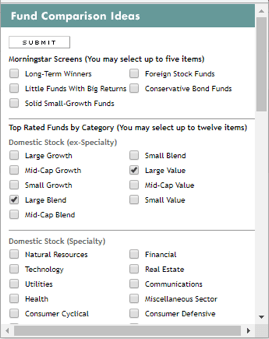

- Return to the Edit Funds page. Click on the Fund Comparison Ideas hyperlink. Check the appropriate Morningstar Category box on the resulting pop-up.

Hit the Submit button to return to the Edit Funds page.

- On the Edit Funds page, hit the Show Comparison button

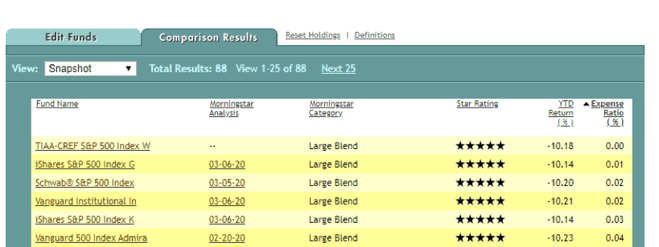

- Sort the results page by Expense Ratio so the lowest expensive ratios display first. To find an index fund, look for the word “index” in the fund name.

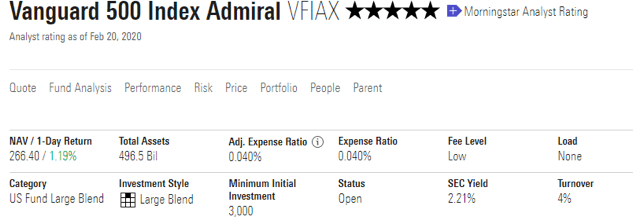

Select a fund for comparison by clicking its hyperlink. I will use the Vanguard 500 Index Admiral fund (Ticker = VFIAX) as an example.

Enter the name of the fund, its ticker and expense ratio into your spreadsheet.

- Compare the returns. In the example, the MITHX fund delivered lower returns than the less costly VFIAX. While the MITHX fund pays 0.25% of assets in revenue sharing, these 401(k) provider fee payments do not fully account for the fund’s lower returns.

|

|

Fund Name |

Fund Ticker |

Morningstar category |

Expense Ratio |

1-year return |

5-year return |

|

Current Fund |

MFS Massachusetts Investors Tr R3 |

MITHX |

Large Blend |

0.71% |

0.35% |

7.98% |

|

Alternative Fund |

Vanguard 500 Index Admiral |

VFIAX |

0.04% |

1.91% |

8.82% |

If you find a fund with similar (or superior) returns for lower fees, talk to your 401(k) provider about the possibility of replacing your fund with that one – or a different fund with comparable returns.

3) Renegotiate with Your Current Provider

Oftentimes when 401(k) plans grow, they become more valuable (i.e., profitable) to providers. At this point, plan sponsors have an opportunity to renegotiate their fees. Once you’ve benchmarked your plan and you know how much similar plans are paying, you can take this information back to your provider and use it to negotiate lower fees. You can also get pricing quotes from other providers, which make very good negotiating leverage.

4) Switch to a New Provider

If your current provider does not want to lower their pricing to acceptable levels, then at this point, your only real option is to look elsewhere. The process of switching plan providers isn’t always the easiest, but when you consider how much money you can save yourself and your participants, it’s totally worth it.

How to Lower Your 401(k) Fees as a Plan Participant

1) Replace Your Funds with Index Funds

Your employer is ultimately responsible for selecting your 401(k) plan’s investment lineup. Often, they select a lineup that includes both passively-managed index funds – which try to match the performance of a market index – and actively-managed funds – which try to outperform their market index benchmark. In general, actively-managed funds cost more. The problem? Most actively-managed funds actually underperform their market benchmark over time, net of fees charged. That means there’s a good chance you are paying higher fees for lower investment returns with actively-managed funds vs. “comparable” index funds (basically, funds with similar holdings).

If your 401(k) account is earning less than market returns with actively-managed funds, consider replacing them with comparable index funds offered by your plan.

2) Lobby Your Employer

Your employer has a fiduciary responsibility to select “prudent” 401(k) plan investments (basically, funds that meet their investment objective for reasonable fees), and to continuously monitor them for ongoing prudence – replacing overpriced funds along the way. However, meeting this responsibility can be easier said than done given the conflicted investment advice that employers often receive from their 401(k) provider.

Think your fund lineup can be improved? Do some research, identify some potential fund improvements, and then make your case to your employer. There’s a good chance they will appreciate your initiative – particularly when their personal investment returns are on the line.

3) Move Your Assets to an IRA

If you still find yourself stuck in a high-cost 401(k), your last resort is to roll your funds into an IRA that uses acceptably low-cost funds – assuming you are eligible for an account distribution. Many IRA providers offer accounts that give you access to low-cost index funds, target date funds, and ETFs without charging you much in the way of administration fees. If you still work for the plan sponsor, continue contributing to maximize any employer match.

Don’t Settle for an Overpriced Plan!

Lowering 401(k) fees increases the investment returns of plan participants dollar-for-dollar – which can ultimately help a participant accumulate a much bigger account balance over time due to the power of compound interest.

Think your 401(k) plan is overpriced? Do something about it! The consequences for paying too much are too high to do nothing.