To make retirement as affordable as possible, 401(k) participants must avoid three investing pitfalls throughout their working years – high fees, underperforming funds, and inappropriate asset allocation. A Target-Date Index Fund (TDIF) can make these pitfalls easy to avoid. For low fees (about 0.10% of assets annually), a TDIF delivers a professionally-managed mix of index funds that automatically becomes more conservative as the investor approaches retirement. It’s tough to beat their net-of-fee returns.

However, the one-size-fits-all investment strategy of TDIFs is not the best fit for every 401(k) participant. Some participants will be better served by a more custom mix of investments.

Here’s what you need to know to determine whether a TDIF is right for your 401(k) account.

Index Funds Tend to Outperform Active Funds

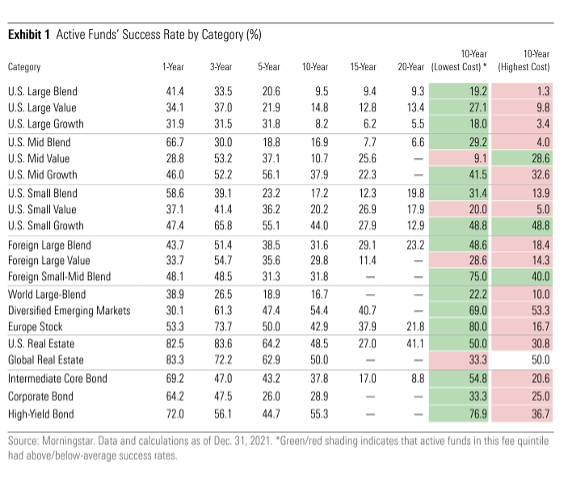

401(k) investment funds can be passive or active in nature. The investment objective of these funds is their difference. Passive funds – which include index funds and ETFs - try to match the returns of a market benchmark (e.g., the S&P 500 index), while active funds try to outperform their market benchmark. Ironically, studies show index funds tend to outperform comparable active funds (i.e., funds with the same market benchmark) over time.

Fees are often the reason why. Active funds can be a lot more expensive than a comparable index fund. Most fail to overcome that handicap with higher returns.

The semi-annual Morningstar’s latest Active/Passive Barometer compares the returns of active and passive funds. The latest report found that only “26% of all active funds topped the average of their passive rivals over the 10-year period ended December 2021; long-term success rates were generally higher among foreign-stock, real estate, and bond funds and lowest among U.S. large-cap funds.”

TDIFs Deliver Set-It-And-Forget-It Investment Advice

To invest appropriately, 401(k) participants must construct - and maintain – a diversified mix of investments based on their time horizon (time to retirement) and risk tolerance. An appropriate investment mix balances the participant’s growth potential with the risk of losses. Striking this balance is important. Otherwise, a participant could miss out on returns by investing too conservatively when young or sustain unrecoverable losses by investing too aggressively when older.

Given the stakes, it’s no surprise that many 401(k) participants want professional help investing their account. This makes even more sense when you consider the complex investing strategies participants must apply to maintain an appropriate investment mix throughout their working years:

-

-

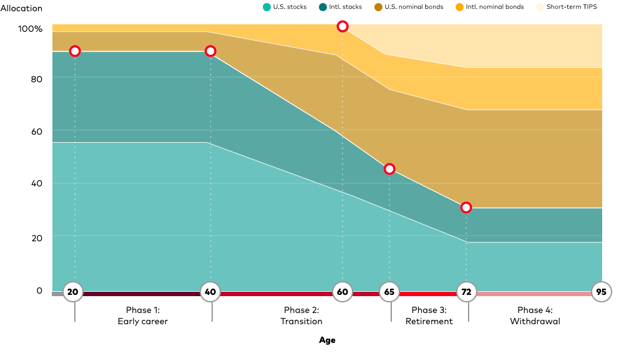

- Asset allocation involves the allocation of an investment mix among different asset categories, such as stocks, bonds, and cash based on time horizon and risk tolerance. In general, young participants should invest heavily in stocks – which have higher growth potential but are more volatile. Older participants should invest more conservatively.

- Diversification involves picking investments with uncorrelated returns for an asset allocation. This way, if one investment is declining, others are more likely to be growing, or at least not declining as much – minimizing the risk of large losses.

- Rebalancing involves periodically buying or selling assets in a mix to maintain a desired level of asset allocation.

-

TDIFs apply these investing strategies based on the estimated retirement date of the investor. To invest appropriately, 401(k) participants just need to invest 100% of their account (not a lesser percentage) in the TDIF that best matches their estimated retirement date. A TDIF’s investment mix will automatically become more conservative as the investor approaches retirement. This transition is called a glidepath. TDIF glidepaths can vary somewhat.

Here’s the glidepath for Vanguard TDIFs.

The Pros and Cons of TDIFs

When investing for retirement, it’s tough to beat the set-it-and-forget-it convenience and net-of-fee returns of TDIFs. However, their investment mix only solves for one variable – retirement date. That’s probably fine for participants with little to no outside assets, but many participants have significant outside assets – a brokerage account, IRA, real estate, etc. For these participants, an investment mix that factors their outside assets might be a better fit.

The pros and cons of TDIFs include:

| Pros | Cons |

|

|

At Minimum, TDIFs Should Be a Benchmark

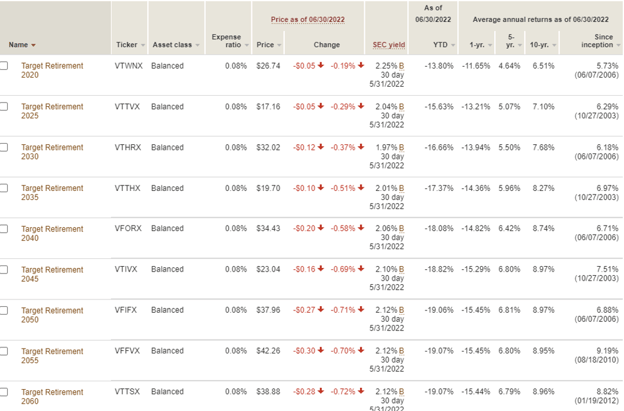

One-size-fits-all investments like TDIFs will never fit every 401(k) participant. However, it’s tough to beat their net-of-fee returns. Here’s how Vanguard TDIFs performed in recent years:

For 401(k) participants who want something different, I think TDIFs can still serve an important purpose – as a benchmark. A 401(k) account should earn no less over time - net of investment expenses and service provider fees.