In multiple lawsuits, Fidelity Investments is being accused of charging excessive, undisclosed 401(k) fees. At issue is an “infrastructure fee” the company demands from some third-party mutual funds in return for access to Fidelity 401(k) clients. Fidelity claims the fee is not 401(k)-related. The lawsuits claim otherwise, saying the fee represents indirect compensation – a form of 401(k) fee that must disclosed in a 408b-2 fee disclosure to be legal under the Employee Retirement Income Security Act (ERISA).

My opinion? The infrastructure fee represents indirect compensation. After all, it would increase the cost of investing for 401(k) plan participants when applied.

In my view, the current 408b-2 fee disclosure rules make it too easy for 401(k) providers to do what Fidelity is accused of doing - obfuscate indirect compensation. That’s a big problem for business owners who rely on 408b-2 information to confirm their 401(k) fees are both reasonable and necessary – an important fiduciary responsibility. Below are 408b-2 fee disclosures that I feel make it too difficult for business owners to evaluate indirect compensation. I think they demonstrate the need for 408b-2 reform.

What is indirect compensation?

401(k) providers can be compensated from three sources today – the plan sponsor, participant accounts or plan investments. 401(k) fees paid by the plan sponsor or participant account deduction are considered “direct compensation,” while fees paid by plan investments are considered “indirect compensation.” Revenue sharing and wrap fees are the two most common forms of indirect compensation.

401(k) providers are obligated by ERISA to describe all direct and indirect compensation in their 408b-2 fee disclosure.

Paychex 408b-2

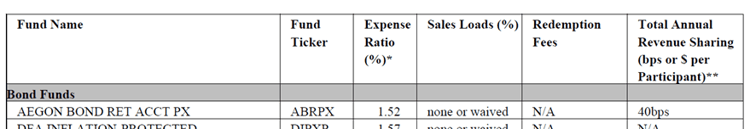

Paychex used to disclose revenue sharing payments for all its 401(k) plan clients in Schedule A - Investment Related and Revenue Sharing Detail section of its 408b-2 disclosure - specifically, in the Total Annual Revenue Sharing (bps or $ per Participant)** column.

Then about a year ago, the column disappeared for some 401(k) plans with funds that pay revenue sharing. My guess? Paychex is dropping the column when fund revenue sharing is refunded to participant accounts via fee levelization. These plans are then invoiced a direct fee.

If my guess is right, I don’t like the approach at all. It would require 401(k) fiduciaries to trust Paychex is refunding 100% of the revenue sharing it receives.

John Hancock 408b-2

Like comedian John Oliver, I believe John Hancock 401(k) fees are too high. I also think their 408b-2 disclosure needs improvement. The reason - it discloses indirect compensation as a percentage of assets, instead of dollars.

Why is this a problem? Check out this JH 408b-2 disclosure for a 10-participant 401(k) plan with $2,113,454.88 in assets. It says the plan pays 0.42% in JH fees and another 0.55% in other fees – which probably go to a financial advisor. That may not sound bad until you understand that the 0.97% represents $20,500.51, or $2,050.05/participant, annually. Yikes!

The Fidelity 408b-2

Fidelity began charging its so-called infrastructure fee in 2016 or 2017. Because the fee increases the cost of investing for 401(k) participants like wrap fees and revenue sharing, I consider it indirect compensation.

Fidelity disagrees. Below is how they footnote the fee in a 408b-2 disclosure I reviewed recently (see page 6):

Fidelity may receive a fee from unaffiliated product providers to compensate Fidelity for maintaining the infrastructure to accommodate unaffiliated products. The fee is a fixed amount that typically equates to less than 0.05% of a product provider's assets in all retail, workplace, and intermediary channels maintained by Fidelity and does not vary based on a plan's offering of an unaffiliated product supported by Fidelity. In addition, such unaffiliated product providers may pay Fidelity initial start-up fees, product add, and maintenance fees as well as a provider minimum monthly fees. These fees are not in connection with Fidelity's services to the plan and are not considered indirect compensation under the 408(b)(2) regulations.

It's time for 408b-2 reform!

When final 408b-2 regulations were released in 2012, they were a big step forward in improving the transparency of 401(k) provider fees – making it easier for business owners to protect the interests of their 401(k) plan participants and avoid fiduciary liability. However, they did not mandate a format for disclosure. Some 401(k) providers took advantage by burying their indirect compensation

To address this shortcoming, 408b-2 reform is necessary. Fortunately, the fix is simple. The DOL just needs to mandate a standard 408b-2 summary for 401(k) providers that totals all direct and indirect compensation into a single “all-in” fee amount. That way, business owners can compare 401(k) provider fees on an apple-to-apples basis.

That may be too much to hope for given the 401(k) industry opposition this sort of transparency would face. In the meantime, I have a simple solution for business owners that don’t know the dollar amount of indirect compensation paid by their 401(k) plan – replace your 401(k) provider with one that charges 100% direct fees.