The Frugal Fiduciary Small Business 401(k) Blog

Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs.

John Oliver Should Be Upset; His Hancock 401k Fees Are Too High!

By: Eric Droblyen

June 29th 2016

John Oliver attacks his company’s John Hancock 401k plan. Hancock makes misleading statements in rebuttal. What’s the truth about Hancock 401k fees?

Read More

401(k) Disclosure Rules Are Out of Date; It’s Time for Common Sense Reform

By: Eric Droblyen

June 1st 2016

Current ERISA regulations make electronic delivery of participant disclosures risky for small business 401(k) fiduciaries. It's time for reform.

Read More

SEC Money Market Reform Will Affect Many Small Business 401(k)s in 2016; 401(k) Fiduciaries Should Understand its Consequences

By: Eric Droblyen

March 9th 2016

SEC money market reforms will take effect in 2016. If a 401(k) includes a money market fund in its investment lineup, small business fiduciaries should understand the consequences of these reforms in order to decide if their plan’s money market fund should be replaced in advance of the new rules.

Read More

A Common Sense 401(k) Reform - Retirement Labels and Receipts

By: Eric Droblyen

July 15th 2015

Retirement labels and retirement receipts could save 401(k) investors billions each year.

Read More

Watered-Down Fiduciary Rule May be the Best Case Scenario for Investors

By: Eric Droblyen

April 22nd 2015

DOL Releases Their Long-Awaited Fiduciary, or “Conflicts of Interest,” Rule.

Read More

Jerry Schlichter Interviewed by Frontline; 401(k) Sponsors Should Take Note

By: Eric Droblyen

March 11th 2015

Jerry Schlichter Interviewed on Frontline; Tibble vs. Edison case may change 401(k) investment monitoring standards.

Read More

Keeping my Fingers Crossed for 401(k) Reform in Tonight’s SOTU Address

By: Eric Droblyen

January 20th 2015

Small business retirement plan reform in 2015 State of the Union address. Hopefully a fiduciary standard to 401(k) savers are clear, conflict-fee advice at reasonable fees

Read More

MyRAs are not the answer for expanding retirement plan coverage

By: Eric Droblyen

January 6th 2015

MyRAs not yet a strong alternative for small business retirement plans. The President and Congress need to work together to give workers more options.

Read More

Let’s put “Income” back in ERISA

By: Greg Carpenter

November 13th 2014

We recommend the government and industry nudge plan participants toward better retirement income results. Tweak ERISA by allowing more competition.

Read More

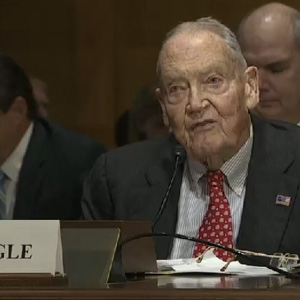

Vanguard’s John Bogle makes his case for improving 401(k) plans. Here’s why his Senate testimony rocks.

By: Greg Carpenter

September 24th 2014

John Bogle details the flaws in the current regulations governing 401(k) plans and the mutual fund industry putting profits above fiduciary duty.

Read More