The Frugal Fiduciary Small Business 401(k) Blog

Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs.

SECURE 2.0’s Automatic Enrollment Mandate for 401(k)s – What Employers Need to Know

By: Eric Droblyen

March 26th 2024

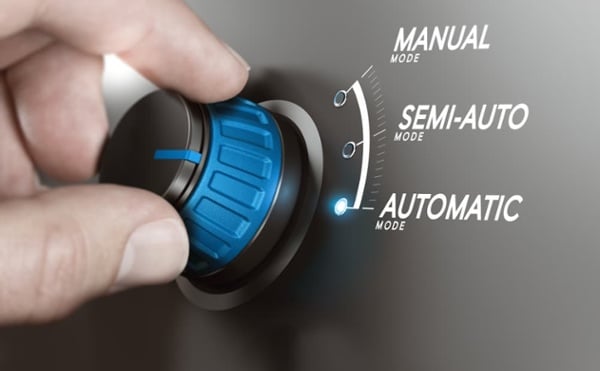

SECURE 2.0 requires new 401(k) plans to implement an automatic enrollment feature in 2025 unless an exception applies. Here's what employers need to know.

Read More

401(k) Long-Term, Part Time Rules – What Employers Need to Know

By: Eric Droblyen

December 5th 2023

The SECURE Act’s long-term, part-time rules for 401(k) plans are complicated. Plan design changes can help employers with part-time employees avoid them.

Read More

Is Your Company Part of an Affiliated Service Group? Know for Certain or Risk 401(k) Plan Disqualification

By: Eric Droblyen

October 24th 2023

Determining whether your company is part of an affiliated service group is complex, but necessary to avoid plan errors which can result in plan disqualification.

Read More

How to Prepare Your 401(k) Plan for SECURE 2.0 Changes

By: Brian Furgala

July 18th 2023

Not preparing a 401(k) plan for SECURE 2.0 could lead to lower contribution limits, missed tax breaks, or unnecessary administration. Here are changes to consider.

Read More

401(k) Eligibility: When to Let Employees Join Your Plan

By: Eric Droblyen

April 11th 2023

Company goals, employee demographics, and plan features are all factors small businesses should consider when choosing 401(k) eligibility terms.

Read More

Automatic Enrollment – Is It Right for Your Small Business 401(k) Plan?

By: Brian Furgala

March 14th 2023

Learn the 3 options of automatic enrollment in a 401(k) plan and decide which is right for your business. Plus, read the latest changes from SECURE 2.0.

Read More

401(k) Plan Design Choices to Simplify Annual Admin the Most

By: Eric Droblyen

December 6th 2022

Proper 401(k) plan design can reduce the time employers must spend on annual plan administration by hours. We outline the simplest options to administer.

Read More

The Ultimate Guide to Safe Harbor 401(k) Plans

By: Eric Droblyen

March 30th 2022

Safe harbor 401(k) plans are popular with small businesses that struggle to pass IRS-mandated nondiscrimination testing. Our guide answers common questions.

Read More

How to Simplify Your 401k Admin with a Cycle 3 Plan Restatement

By: Eric Droblyen

July 21st 2021

Most 401(k) plans must be "restated" to reflect IRS-mandate Cycle 3 changes from August 1, 2020 to July 31, 2022. Here are some plan simplifications to consider.

Read More

Is Your Company Part of a Controlled Group? You Need to Know or Risk 401(k) Plan Disqualification

By: Eric Droblyen

May 26th 2021

IRS controlled group rules often obligate 2 or more employers with common ownership to cover their employees with the same 401k plan in order to pass annual nondiscrimination testing.

Read More