On August 31, President Trump signed an Executive Order on Strengthening Retirement Security in America. In the order, the President made it the “policy of the Federal Government to expand access to workplace retirement plans for American workers.” While I fully support the policy – not enough workers are covered by a workplace retirement plan – I don’t think the order’s proposals will motivate more employers to offer a retirement plan. Other changes would be more effective.

In the order, President Trump directed the Departments of Labor (DOL) and Treasury (DOT) to consider three major regulation changes – reduce barriers to Multiple Employer Plans (MEPs), reform participant disclosure rules, and loosen Required Minimum Distribution (RMD) requirements. My analysis of each directive can be found below. My recommendations for expanding retirement plan coverage follow.

Reduce barriers to open MEPs

An MEP is a 401(k) plan that covers the employees of two or more unrelated employers. For years, the financial services industry has marketed MEPs as a way for small employers to pool resources and obtain quality 401(k) administration services and investments for lower fees due to economies of scale. “Association” MEPs have been around for decades. Under current DOL rules, only employers with a common affiliation (or nexus) can join an association MEP. President Trump wants this requirement dropped so any employer can join a MEP. He also wants the IRS to drop their “one bad apple rule” – which could disqualify an entire MEP if just one participating employer fails to correct a mistake. DOL and DOT are supposed to propose amendments to these regulations within 180 days.

In my view, this directive will do little – if anything – to make retirement plans more affordable due to the rise of passively-managed investments. While 401(k) plans often need lots of assets to access the top actively-managed funds, even start-up plans with no assets can access the top index funds and ETFs – no economies of scale required. The kicker? These funds often outperform their actively-managed counterparts, net of fees. They also offer a clear and simple way for employers to meet their investment-related 401(k) fiduciary responsibilities. In short, passively-managed investments have made MEPs obsolete.

Reform participant disclosure rules

Participant disclosures are intended to help 401(k) plan participants make informed decisions about their account. Unfortunately, the participant disclosure rules are out of date. They fall short for two key reasons:

- The number of required disclosures has grown dramatically during the past 15 years. Much of this information is redundant, making new information more difficult to discern and act upon.

- 401(k) plans need to jump through too many hoops to use cheap modern technology for distributing disclosures, increasing expenses unnecessarily.

President Trump wants to make participant disclosures “more understandable and useful for participants and beneficiaries, while also reducing the costs and burdens they impose on employers and other plan fiduciaries responsible for their production and distribution.” In my view, this reform is long-overdue! DOL and DOT are supposed to propose amendments to these regulations within one year.

Increase the age for RMDs

A Required Minimum Distribution (RMD) is the minimum amount a person must withdraw from their retirement account(s) each year. Generally, these withdrawals must start at age 70½.

President Trump wants people to have the flexibility to keep more money in their retirement account longer. With people living longer, I think this reform makes sense. DOL is supposed to propose amendments to these regulations within 180 days.

My recommendations to expand coverage

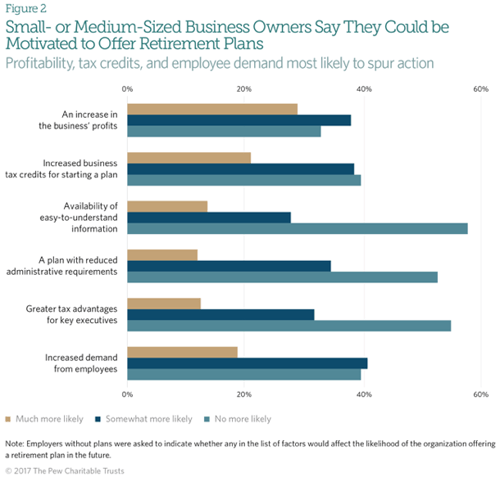

The same Pew study cited by President Trump’s executive order also asked employers what factors would motive them to offer retirement plan. Their responses were:

In my view, Trump’s executive order will do little to help these factors. Below are my suggestions:

- Make 401(k) providers fees more transparent by outlawing revenue sharing and wrap fees. Because the dollar amount of these “hidden” 401(k) fees is not reported in ERISA section 408b-2 and 404a-5 fee disclosures or plan statements, they can be easily overlooked – making excessive 401(k) fees more likely.

- Improve 401(k) tax credits. Simply put – the tax credits for sponsoring a 401(k) plan By increasing amount and duration of tax credits to just $2,000/year, many small businesses could pay nothing at all for sponsoring a low-cost 401(k) plan.

- Create a “safe harbor” for picking a 401(k) fund lineup. Employers have a fiduciary responsibility to pick enough “prudent” funds to allow participants to sufficiently diversify their account. I think a safe harbor fund lineup could help employers rest easy they’ve met this responsibility.

- Require all 401(k) fees to be reported on Form 5500s. Small business 401(k) plan fees are rarely reported on Form 5500s, which means they can’t be data mined. That makes it harder for employers to benchmark their 401(k) fees for reasonableness. A proposed overhaul to the Form 5500 would have helped fix this issue, but this initiative stalled.

- Reform ERISA 408b-2 fee disclosure rules. A standardized disclosure format would help employers evaluate their plan fees for reasonableness and compare service provider fees apples-to-apples.

A better alternative for expanding retirement plan coverage? 401(k) plans modeled after the Federal TSP

Bottom line, I think President Trump’s order will do little to advance his policy objective to expand retirement coverage because it fails to address the major reasons why employers don’t offer a plan today. What’s needed are retirement plans that do two things – 1) cost little to nothing to offer to employees 2) give employers confidence they’ve met their fiduciary responsibilities.

MEPs don’t do that. They don’t cost less than traditional single-employer 401(k) plans – I invite anyone to prove me wrong! – but are more complicated and prone to abuse. A better alternative? 401(k) plans modeled after the Federal Thrift Savings Plan (TSP) – our nation’s largest and lowest-cost retirement plan. Such plans make meeting 401(k) fiduciary responsibilities as straightforward as possible for less than $2,000 per year to offer – an amount the government could easily offset with a more generous tax credit!