If you have questions about Vanguard 401(k) fees – how they work, how much they cost on average, or how you can find & calculate them for your plan – you’ve come to the right place. In this guide, we’ll show you how to calculate the full cost of a Vanguard 401(k) plan using their DOL-mandated fee disclosure.

By the end of this guide, our aim is for you to have a complete understanding of how Vanguard’s pricing works, how much you’re paying, and how your fees stack up.

Let's dive in.

What are Average Vanguard 401(k) Fees?

We have evaluated the fees of a few Vanguard plans over the years as part of our 401(k) fee comparison service. Below are the averages we found for these plans.

|

Average Vanguard 401(k) Fees |

|

|

Avg. Plan Assets |

$146,033 |

|

Avg. Plan Participants |

12 |

|

Per-Capita Admin Fees |

$333.70 |

|

All-In Fees |

2.71% |

The most notable (and atypical) thing about Vanguard as a small business 401(k) provider is that they charge no “hidden” fees for plan administration like revenue sharing or variable annuity wraps. Charging no hidden fees makes it much easier for small businesses to calculate the total cost of a Vanguard plan. We’ll show you how to do so next.

How to Find & Calculate Vanguard 401(k) Fees

To understand how much you’re paying for your Vanguard plan, I recommend you sum your admin fees and investment expenses into a single “all-in” fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare your cost with competing 401(k) providers and/or industry averages.

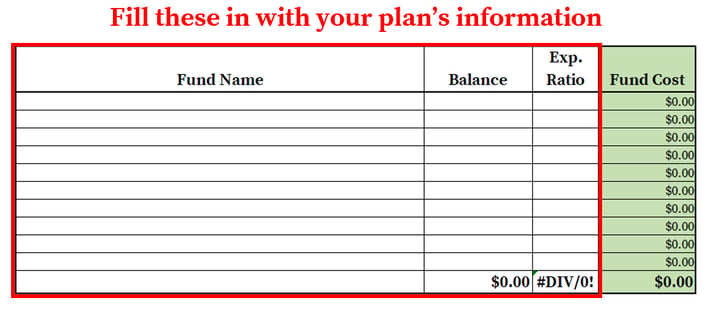

To make this easy on you, we’ve created a spreadsheet you can use with all the columns and formulas you’ll need to total your plan’s cost. All you need to do is find the information for your plan, then enter it into the spreadsheet.

Doing this for Vanguard is fairly straightforward. We’ll show you everything you need to do in 4 simple steps.

Step 1 – Gather All the Necessary Documents

To calculate your Vanguard 401(k) fees, you’ need 2 documents:

- Disclosure of Services and Fees: Vanguard is obligated by Department of Labor regulations to provide employers with a 408(b)(2) fee disclosure. This document contains plan-level information on the direct fees they’re charging, as well as any revenue sharing payments they receive from the funds. This information is intended to help employers evaluate the “reasonableness” of their 401(k) fees. This document can be found on the Vanguard employer website.

- Statement of Assets Report: this document (labeled “Fund Detail”) provides a breakdown of how much money is invested in each fund in your 401(k) plan. These are also sent each year, and can be found on the employer website.

Once you’ve gathered all the necessary documents, you’re ready to move on to step 2.

Step 2 – Locate Vanguard’s Direct 401(k) Fees

401(k) administration fees can be “direct” or “indirect” in nature. Direct fees can be deducted from participant accounts or paid from a corporate bank account, while indirect fees are paid from investment fund expenses, reducing their annual returns.

Direct fees are the most transparent and are probably the ones you’re most familiar with.

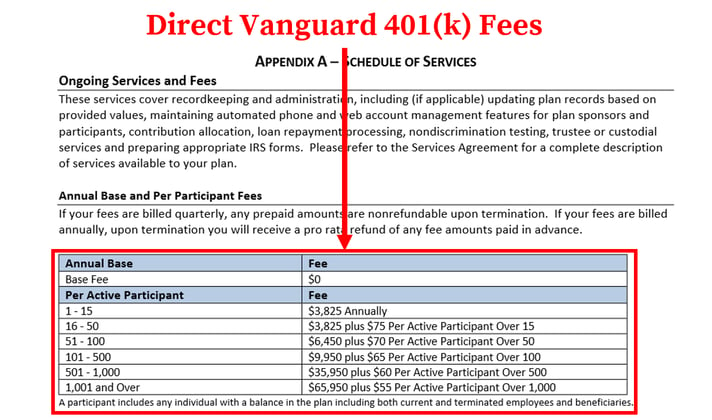

100% of Vanguard’s administration fees are direct. The amount that Vanguard charges your plan can be found in the “Appendix A – Schedule of Services” section of their 408(b)(2) fee disclosure:

Step 3 – Locate Vanguard’s Expense Ratios & Fund Balances

To calculate our fund costs, we’ll need information from two documents.

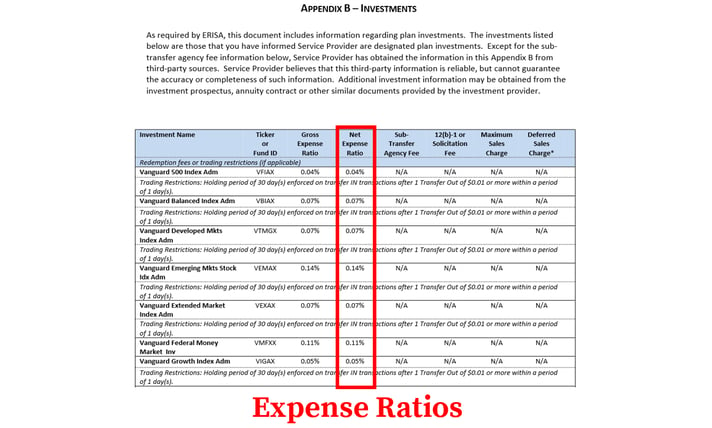

First, we’ll need the expense ratios of each of the funds in your plan. These can be located in the “Appendix B – Investments” section of your Vanguard 408(b)(2):

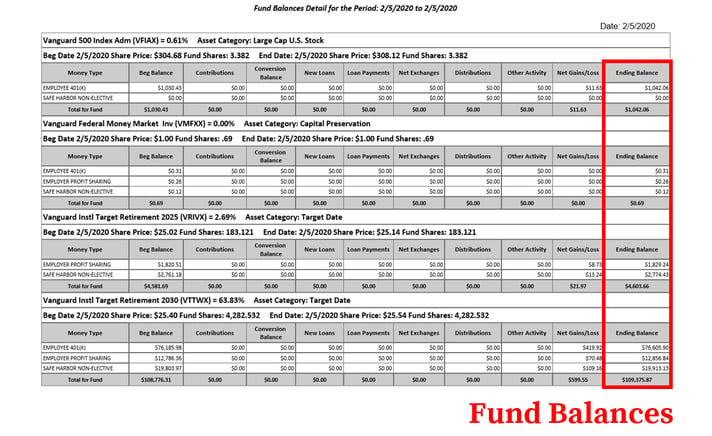

Next, we’ll need to locate the balance for each fund in your Statement of Assets (labeled “Fund Detail”) report:

In step 4, you’ll multiply your fund balances by their expense ratio to get the fund costs for your Vanguard plan.

Step 4 – Calculate Your All-In 401(k) Fee

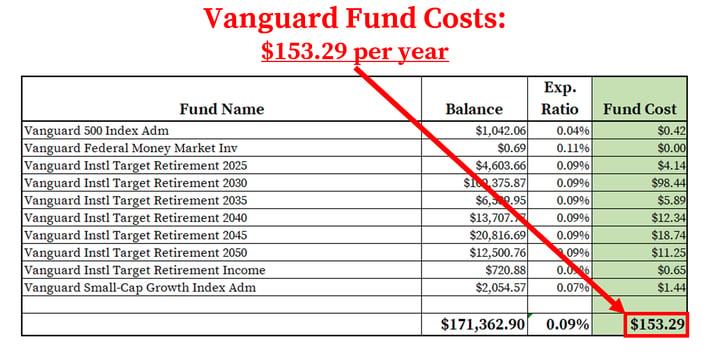

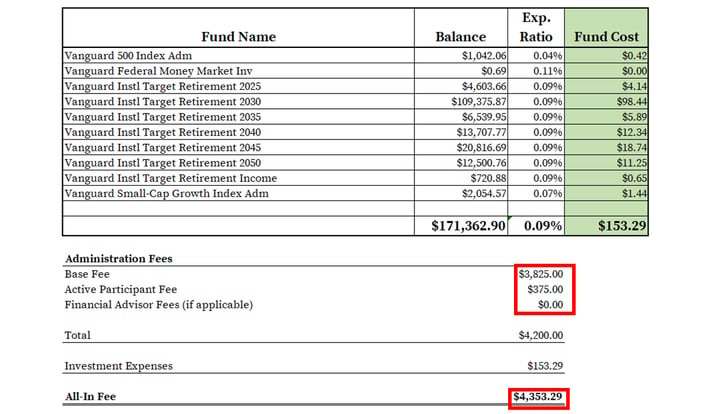

In this step, we’ll enter the information we found into our spreadsheet to calculate your plan’s total cost – or “all-in” fee.

First, enter the fund information from your Vanguard 408(b)(2) and Statement of Assets documents into the spreadsheet. The formulas will automatically calculate your fund costs.

Next, we need to calculate your direct fees.

Vanguard uses a graduated per-participant model, so you need to multiply the number of participants you have over a certain threshold by the applicable price, and then add that to Vanguard’s annual base fee.

Our example has 20 participants. Based on the Vanguard fee schedule we found, its direct fees is $4,200.

At this point, all of your administration fees and investment expenses (net of indirect fees) should be broken out and totaled, giving you the all-in fee of your Vanguard plan ($4,353.29 in our example).

At this point, all of your administration fees and investment expenses (net of indirect fees) should be broken out and totaled, giving you the all-in fee of your Vanguard plan ($4,353.29 in our example).

To make it easier for you to benchmark your fees against other plans, we recommend expressing this number as a % of plan assets. In our example, this number is 2.55% ($4,353.29 /$171,362.90).

Evaluate Your Admin Fees on a Per-Capita Basis

After you have calculated your all-in fee, we recommend you take a quick look at your Vanguard administration fees on a per-capita (i.e., headcount) basis.

The reason?

Excess administration fees – basically, fees that outstretch your 401(k) provider’s level of service – might not be readily apparent if they’re solely evaluated on an all-in basis with investment expenses. This is especially true if your plan has lots of assets.

To demonstrate the value of this evaluation, consider a $1,625,825.48 401(k) plan with only 7 participants from our 2018 small business 401(k) fee study. While its $25,611.64 all-in fee (1.58% of plan assets) was only a bit above the study’s 1.40% average, its $2,521.81 per capita administration fee ($17,652.64/7 participants) was about six times average!

To calculate your per-capita administration fees, simply divide the administration fee total from your spreadsheet by the number of participants in your plan. For our 20-participant example, that number is $210.00 – quite a bit higher than what participants could be paying with a low-cost 401(k) provider.

Consider Other Low-Cost 401(k) Options

By now, you should have a complete breakdown of your Vanguard 401(k) fees and how they’re being charged.

Vanguard 401(k) fees are transparent, easy-to-understand, and are not charged as a percentage of plan assets. Considering the prevalence of revenue sharing and other hidden fees in the 401(k) industry, Vanguard could be an excellent provider for keeping your 401(k) fees under control.

That said, their pricing model can also be on the expensive side for startup plans, as well as plans with lots of participants. Whether you’re shopping for a new 401(k) provider, or just doing research to see how your plan compares, be sure to consider other low-cost 401(k) providers – ideally, those that are transparent and don’t hide asset-based fees in your fund expenses. A little shopping around might save you and your participants a lot of money over the long haul.