Employers that sponsor a 401(k) plan have a fiduciary responsibility to pay only reasonable fees from plan assets. Keeping 401(k) fees in check is one of the most important 401(k) fiduciary responsibilities because excessive fees reduce investment returns unnecessarily, making a secure retirement for plan participants less affordable. Not meeting this responsibility can also mean severe consequences for the employer – including personal liability.

And yet, despite these consequences, many employers needlessly increase their risk for paying excessive 401(k) fees by hiring a 401(k) provider that charges “hidden” fees - like revenue sharing or wrap fees – paid by plan investments. Unlike “direct” fees paid by participant account deduction, 401(k) providers are not obligated to report the dollar amount of hidden fees in DOL-mandated fee disclosures. Instead, they can be buried in investment expense ratios.

If you sponsor a 401(k) plan for you and your employees, I recommend avoiding 401(k) providers that charge hidden fees – they make it harder for you to avoid excessive 401(k) fees that handicap participant returns and increase your personal liability. Unsure your 401(k) charges hidden fees? Answer two questions to find out.

Do your 401(k) plan investments pay wrap fees?

If your 401(k) provider is an insurance company, there is a good chance your plan investments are variable annuities, not mutual funds. Variable annuities (also called pooled separate accounts) are basically mutual funds that are owned by an insurance company and then “wrapped” in a thin layer of insurance – adding wrap fees (including sales commissions and surrender charges) in the process. Wrap fees can turn a low cost mutual fund (like an index fund) into a very expensive variable annuity by adding 1% or more to the mutual fund’s expense ratio!

To determine if your 401(k) plan pays wrap fees, check your 401(k) provider’s ERISA 408b-2 fee disclosure. These fees will most likely be reported on a fund-level as an increase to each fund’s expense ratio.

Do your 401(k) plan investments pay revenue sharing?

Some mutual fund companies compensate the 401(k) providers that use their funds. These hidden 401(k) fees are commonly known as revenue sharing. Revenue sharing payments increase investment expense ratios, reducing investor returns. The two most common types of 401(k) plan revenue sharing are:

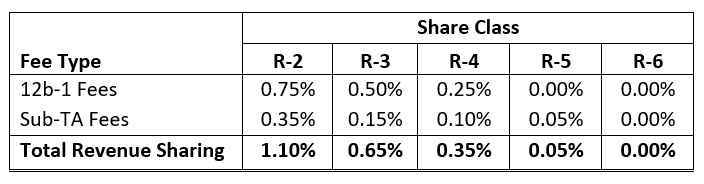

- 12b-1 Fees – Meant to compensate a 401(k) provider for distributing and marketing a mutual fund company’s funds.

- Sub-Transfer Agency Fees (Sub-TA Fees) – Meant to compensate a 401(k) provider for participant-level recordkeeping.

As if revenue sharing wasn’t confusing enough, the mutual fund companies that pay these hidden 401(k) fees tend to offer their funds in multiple sharing classes – with each paying different fees. For example, when a 401(k) fund lineup includes American Funds, one of five share classes are most commonly used – with the most expensive paying 1.10% in annual revenue sharing!

To determine if your 401(k) plan pays revenue sharing, check your 401(k) provider’s ERISA 408b-2 fee disclosure. These fees will most likely be reported on a fund-level as percentage of each fund’s expense ratio. You can also find 12b-1 fees - but not sub-TAs - in fund prospectuses.

Don’t forget to follow this process for variable annuities too. Remember, variable annuities are basically mutual funds with wrap fees added. That means a variable annuity’s mutual fund might also pay revenue sharing!

Confused? Just hire a 401(k) provider with fully-transparent fees!

As a 401(k) plan sponsor, you have a fiduciary responsibility to pay only reasonable 401(k) fees from plan assets. Meeting this responsibility is important because paying excessive 401(k) fees can mean severe consequences for both you and your employees.

To make meeting your fiduciary responsibility as easy as possible, I recommend avoiding 401(k) providers that charge hidden fees. These fees are easy to overlook, making excessive 401(k) fees more likely. The good news? There are plenty of 401(k) providers available that charge 100% fully-transparent fees only. You just have to shop around.