Providers of Multiple-Employer 401(k) Plans (MEPs) – a form of 401(k) plan co-sponsored by two or more unrelated employers - have had a rough time in the courts in recent months. Three providers - ADP, Pentegra, and TriNet - have been accused of charging excessive 401(k) fees, while two others – Insperity and National Rural Electric Cooperative Association (NRECA) - have paid out tens of millions of dollars in restitution. Because providers usually market MEPs as a lower-cost alternative to single-employer 401(k) plans, these lawsuits can seem surprising. I’m not surprised one bit.

Ironically, another purported MEP benefit is the reason why. When business owners join a MEP, they delegate most (if not all) of their traditional 401(k) fiduciary roles to the provider. MEP providers claim this delegation reduces the fiduciary liability of business owners. I think it does the opposite by giving providers too much discretionary control over plan administration. They can abuse this power by layering administration fees or choosing overpriced investments and features for plan participants. Many do just that.

It’s no secret I don’t like MEPs. They don’t lower 401(k) fees – a single-employer plan with an index fund menu and flat administration fees can cost much less – and they’re too prone to abuse. The fiduciary roles that make MEPs more prone to abuse are described below – including how providers can abuse each role.

The fiduciary hierarchy of all 401(k) plans

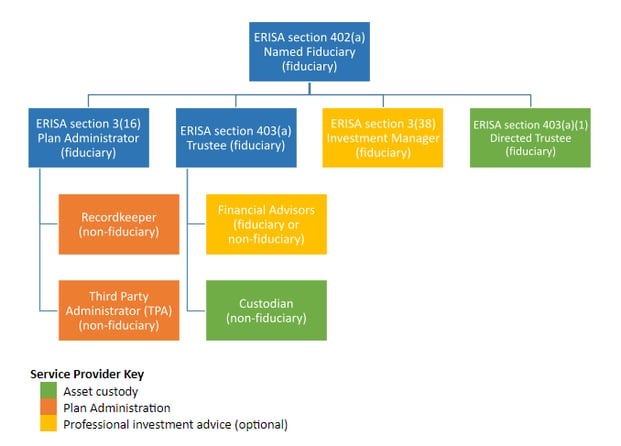

All 401(k) plans (MEP or not) have the same basic fiduciary hierarchy. An org chart of this hierarchy can be found below. It includes both fiduciary and non-fiduciary (“ministerial”) roles. In general, the fiduciary roles have discretionary authority, while the ministerial roles do not. The blue boxes indicate roles traditionally filled by an employer, while the other boxes indicate roles that are most often filled by a professional service provider.

Technically, you can delegate any of these roles to a willing 401(k) provider. However, you can’t just delegate a role and forget about it. You must ”monitor” the delegate’s role performance - to ensure they’re doing a competent job for “reasonable” fees.

- ERISA section 402(a) Named Fiduciary – is designated in the plan document as having the overall authority to control and manage the operation and administration of the plan. Most commonly, the Named Fiduciary is the ERISA section 3(16) Plan Administrator

- ERISA section 3(16) Plan Administrator – is the person or entity "so designated" in the plan document. The employer is the default Plan Administrator if none is designated. The Plan Administrator is basically responsible for any fiduciary responsibility not assumed by the ERISA section 403(a) Trustee.

- ERISA section 403(a) Trustee – is named in a 401(k) plan or trust document and has exclusive authority and discretion to manage and control plan assets.

- ERISA section 3(38) "Investment Manager" – is responsible for investment selection and monitoring. An employer can only delegate this role to a bank, an insurance company, or an RIA subject to the Investment Advisers Act of 1940.

- ERISA section 403(a)(1) “Directed Trustee” – is a type of trustee that lacks the discretion of a full 403(a) Trustee. A Directed Trustee holds plan assets, but does not control them.

- Recordkeeper – is responsible for tracking contributions, earnings and investments on a participant-level and directing the Directed Trustee or Custodian (as applicable) to execute trades requested by plan participants.

- Third-Party Administrator (TPA) – is responsible for annual ERISA compliance (testing, Form 5500, plan document maintenance, participant notice preparation).

- Financial Advisors – are financial professionals, other than a 3(38) Investment Manager, that render investment advice for a fee. Unfortunately, there is a confusing array of Financial Advisors in the 401(k) market – including brokers, insurance agents, investment advisers and financial planners. The key difference between them is their mandated standard of care.

- Investment advisers are subject to a fiduciary standard that requires them to act in the best interest of 401(k) plan participants – in short, given impartial (unbiased) advice. These advisors are usually paid a flat fee regardless of the advice given.

- Other advisors are subject to a lesser suitability standard. Compensation for these advisors can vary based on the advice they give, creating a conflict-of-interest.

- Custodian – is similar to a Directed Trustee – they hold plan assets, but generally lack any discretionary authority with respect to those assets.

The 401(k) fiduciary roles most prone to abuse

In general, the 401(k) fiduciary roles traditionally filled by business owners have the broadest discretion. That’s exactly the reason why I don’t think business owners should delegate them to their 401(k) provider (MEP or not). Their broad authority makes them more prone to abuse.

- ERISA section 402(a) Named Fiduciary - the top dog in 401(k) fiduciary hierarchy has the power to appoint all of the other fiduciary and ministerial roles. A 401(k) provider can abuse this power by appointing related companies to these roles to layer fees.

- ERISA section 403(a) Trustee – This role has discretionary control over plan assets. A 401(k) provider can abuse this power by stealing from the plan’s trust account and/or falsifying trust statements. In 2013, Matthew Hutcheson was sentenced to over 17 Years in prison for misappropriating more than $5 million in MEP assets - $2 million for personal use and $3 million to purchase a country club.

- ERISA section 3(16) Plan Administrator – This role has discretionary control over plan administration. A 401(k) provider can abuse this power by approving fraudulent distribution and loan requests. In 2018, Jeffrey and Wendy Richie (co-owners of Vantage Benefits Administrators) were charged with conspiracy, theft from an employee benefit plan, wire fraud and aggravated identity theft after submitting fraudulent distribution requests.

Will PEPs offer less risk? Probably not…

For nearly 10 years, the financial services industry has lobbied Congress hard to expand small business access to MEPs. This push is hardly surprising when you understand how their purported benefits can be a red herring to boost profits.

The industry got what they wanted in 2019 when the SECURE Act created Pooled Employer Plans (PEPs) – a form of MEP. Will these plans offer more safeguards against abuse by PEP fiduciaries? Given how excited the industry is about PEPs, I very much doubt it.