Small business owners can have dramatically different goals for their 401(k) plan. While some want to maximize key employee contributions, others want to incentivize plan participation by all employees. Business owners have nearly endless options for meeting these goals – many with very different expenses. The process of matching 401(k) goals to available options is called plan design.

401(k) plan design is a big deal that shouldn’t be undervalued by business owners. It’s not uncommon for a business to save tens of thousands in contribution expenses by choosing one plan design over another and yet still meet their 401(k) goals.

Over the past 20 years, our firm has customized thousands of 401(k) plans to meet the goals and budgets of our small business clients. One of the most common questions we receive during the plan design process is “what are other people doing?” To help answer this question, we studied the contribution and eligibility provisions of 3,975 small business 401(k) plans in 2019. To see if preferences have changed, we completed a new study of 4,330 401(k) plans this month.

If you’re a business owner, we hope you’ll find our latest 401(k) plan design study helpful.

401(k) Contribution Study

Employer contributions are often the biggest expense of a small business 401(k) plan. There are two basic types - matching and nonelective. While 401(k) participants contribute salary deferrals to receive an employer matching contribution, any eligible participant can receive a nonelective contribution (e.g., profit sharing) – even if they make no salary deferrals at all.

During the plan design process, you want to pick the contribution mix that will help you meet plan goals at the lowest cost. Some popular plan goals include:

- Maximize owner contributions at the least possible expense.

- Incentivize salary deferrals by all employees.

- Avoid nondiscrimination test failures.

- Help low-paid employees save for retirement.

- Attract and retain key employee talent.

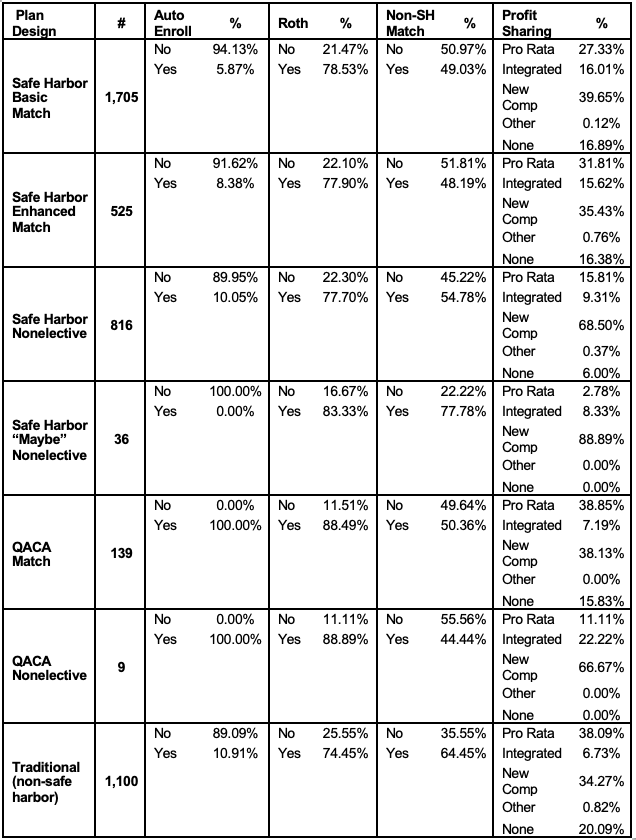

Below is a summary of the contributions used by the 4,330 401(k) plans we studied. Key findings follow the summary.

- 74.60% of plans employ a safe harbor design to automatically satisfy the ADP/ACP and top heavy tests. Up from 69.23% in 2019.

- 11.41% of plans automatically enroll employees that fail to make an affirmative enrollment election. Up from 9.53% in 2019.

- 77.64% of plans permit after-tax Roth contributions. Up from 70.79% in 2019.

- 84.62% of plans permit employer profit sharing contributions. Down a bit from 85.65% in 2019.

- New comparability is the most popular type of profit sharing contribution combined with a safe harbor nonelective contribution. This combination is not surprising when you consider safe harbor nonelective contributions help new comparability contributions pass annual nondiscrimination testing.

401(k) Eligibility Study

A 401(k) plan’s eligibility requirements dictate who can join the plan and who can be kept out. You want to choose these requirements based on your employee demographics and plan goals. When requirements are too liberal, avoidable nondiscrimination test failures and/or expenses are possible. When they are too strict, prospective employees might look elsewhere for employment.

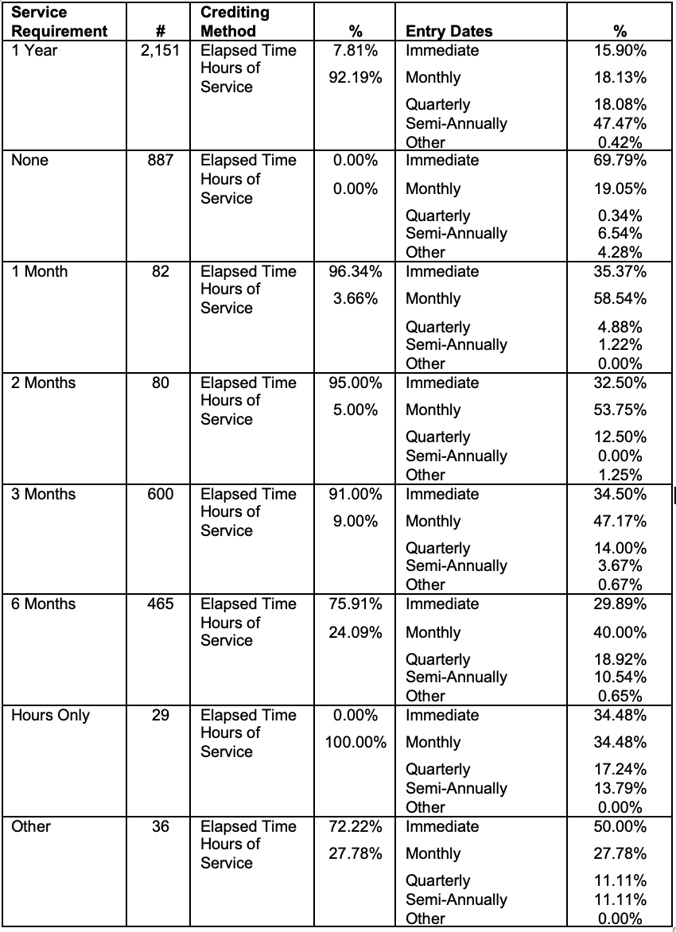

Below is a summary of the service requirements we found for the 4,330 401(k) plans we studied. The two most popular service requirements were one year – used by 49.68% – and none at all - used by 20.48%. Very similar to the percentages we found in our 2019 study.

If your 401(k) provider doesn’t offer custom plan design, run!

401(k) plan design can seem daunting, but in fact, the process can be completed in about a half an hour with the help of a plan design expert. This is time well spent when you consider how bad plan design can cost a small business thousands of dollars in unnecessary contribution expenses annually.

However, not all 401(k) providers are plan design experts. Fortunately, these providers are easy to identify. They only offer cookie-cutter plans instead of consulting. To ensure your 401(k) plan meets your company goals at a low cost, I recommend you avoid these providers.