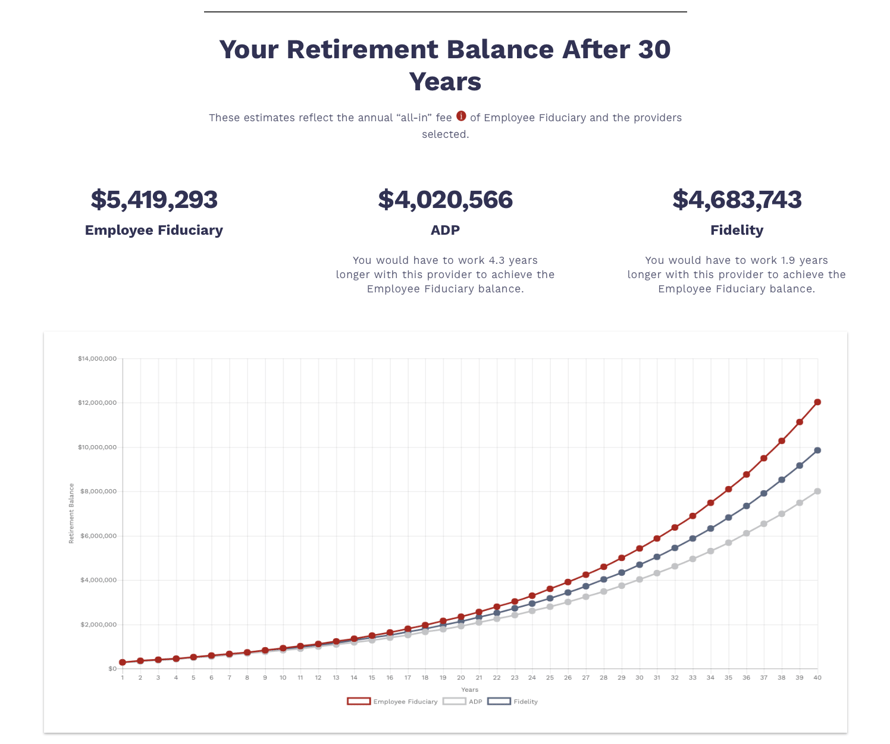

Due to the power of compound interest, 401(k) participants can add hundreds of thousands of dollars to their savings – or retire years sooner - by keeping their account fees as low as possible throughout their working years. And yet, in my experience, few participants appreciate this indisputable truth. Employee Fiduciary would like to help change that. This month, we launched an online calculator to show users how much they can add to their future savings by lowering their 401(k) fees today. Our bet - most users will be shocked by the amount they find.

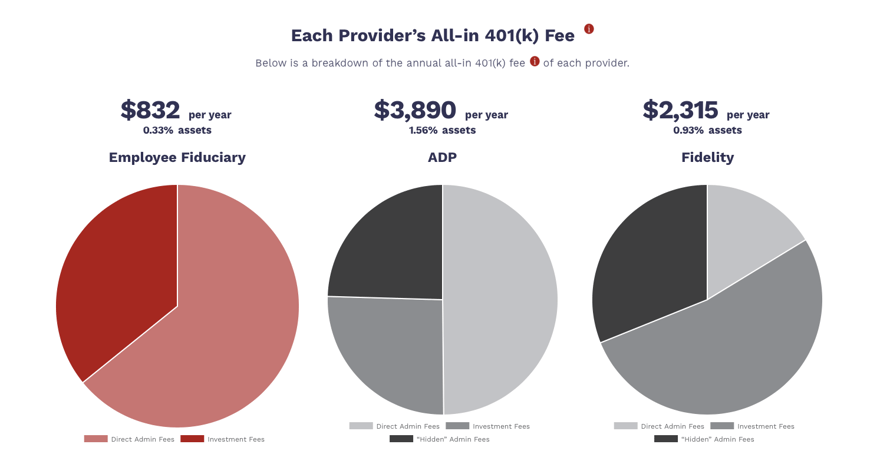

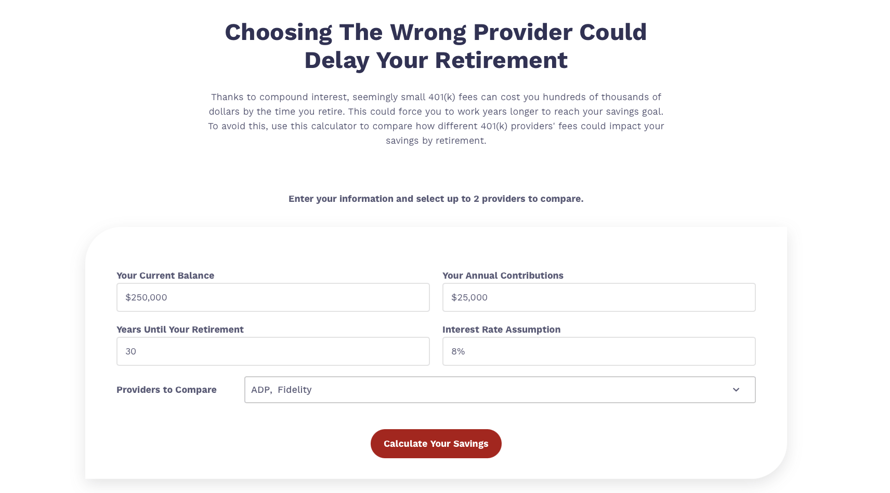

Using our calculator is simple. You just need to answer four questions about your 401(k) account and then select up to two 401(k) providers. Our calculator will then estimate your future account balance assuming your inputs and the “all-in” fee charged by Employee Fiduciary and the 401(k) providers selected. The 401(k) provider fees used in our calculator were found in our latest small business 401(k) fee study.

Cost matters A LOT when saving for retirement. The reason is compound interest. Every dollar you save in 401(k) fees means more savings to compound until retirement. Given enough time, these additional earnings can snowball dramatically. To see how much for yourself, please check out our calculator.

Below is sample calculation. Assuming a 8% annual interest rate, this 401(k) participant would add $1,398,727 to their retirement account ($5,419,293 - $4,020,566) by paying 0.33% in annual fees instead of 1.56% for 30 years.