This month, the Department of Labor (DOL), IRS and Pension Benefit Guaranty Corp (PBGC) proposed changes to the Form 5500 – a report most 401(k) plans must file annually to meet ERISA requirements. Two changes would require large Form 5500 filers to report more 401(k) fee information. I think more fee reporting is necessary.

The reason? The changes won't fix my biggest beef with the Form 5500 today - it does not report the data necessary to develop public and reliable 401(k) fee benchmarks. I would like to see that change to help plan fiduciaries and participants to evaluate the reasonableness of their 401(k) fees – regardless of the size of their plan.

Here are the fee-related Form 5500 changes proposed by the agencies and the ones I would like to see to make reliable 401(k) fee benchmarks possible.

The Form 5500 Versions

There are three versions of the Form 5500 today. Employee demographics and investment options dictate the version a plan must file.

- Form 5500-EZ –Filed by solo (owner-only) 401(k) plans with more than $250,000 in assets. Solo plans with fewer assets have no Form 5500 filing requirement.

- Form 5500-SF –Filed by “small” 401(k) plans – generally plans that cover less than 100 participants – that meet the following requirements:

- The plan satisfies DOL independent audit waiver requirements.

- The plan is 100% invested in “eligible plan assets” with readily determinable fair value (e.g., mutual funds, variable annuities).

- The plan holds no employer securities.

- Form 5500 –Filed by “large” 401(k) plans – generally plans that cover 100 or more participants - and small 401(k) plans not eligible to file Form 5500-SF.

- Unlike the Form 5500 EZ and SF, the Form 5500 is not a single-form return – it must be filed with other schedules.

The agencies only proposed 401(k) fee-related changes for the Form 5500, not the 5500-EZ or 5500-SF.

Proposal #1 – Add Information to the Schedule of Assets

Plans that file a Form 5500 must report their financial condition on a Schedule H. Plan investments must be reported on a Schedule H attachment named the “Schedule of Assets (Held At End of Year).”

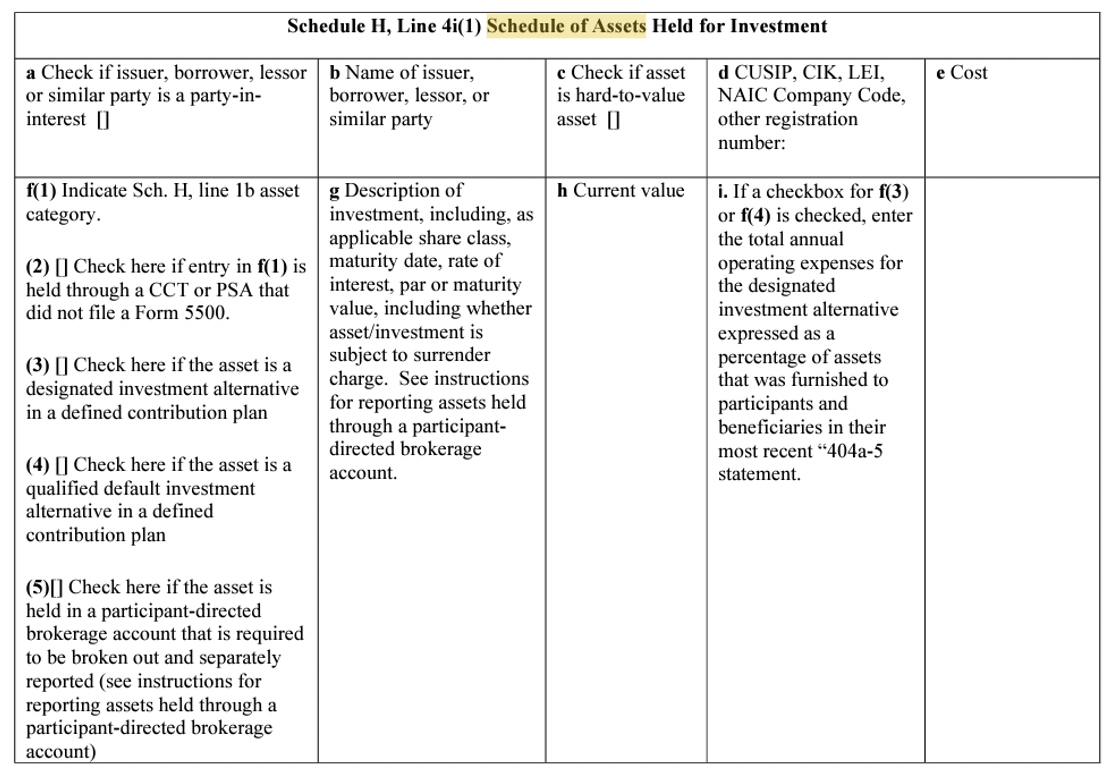

To make this attachment easier to search, filter, aggregate, and analyze. the agencies proposed the following changes:

- Standardize an electronic filing format.

- Require plans to use legal entity and other industry and regulatory identifiers for investment assets whenever possible.

- Add check boxes for participant-directed plans to identify investments that are designated investment alternatives and Qualified Default Investment Alternatives

- Require entry of the total annual operating expenses for the investments expressed as a percentage of assets that was furnished to participants and beneficiaries in their most recent “404a-5 statement.”

I like this change a lot. Adding fund operating expenses and unique identifiers to the schedule should make it easier for plan fiduciaries and participants to compare the fees charged by their investments.

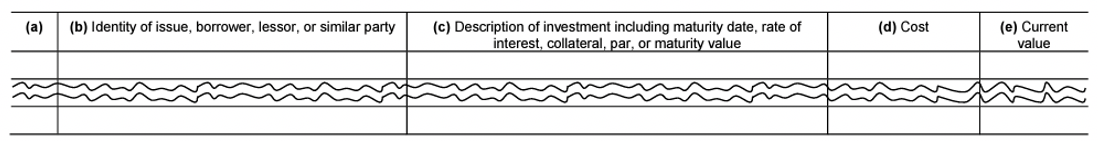

Current schedule:

Proposed schedule:

Proposal #2 - Add More Fee Categories to Schedule H

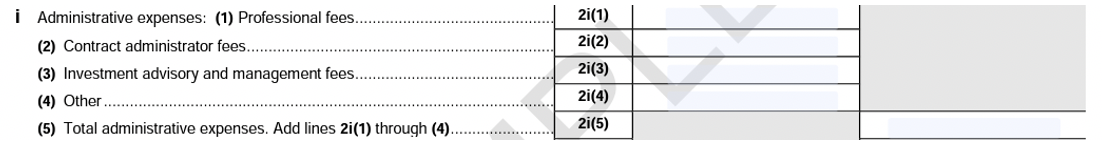

Form 5500 filers must report their administrative expenses in the Income and Expense section of Schedule H.

To get a better picture of plan expenses, particularly those related to service providers, the agencies proposed more expense categories:

- Salaries and allowances

- Independent Qualified Public Accountant (IQPA) Audit fees

- Recordkeeping and Other Accounting Fees

- Bank or Trust Company Trustee/Custodial Fees

- Actuarial fees

- Legal fees

- Valuation/appraisal fees

- Trustee fees/expenses (including travel, seminars, meetings)

Not a big improvement, but a welcome one still.

Our Proposed Changes

I think the Form 5500 should make it simple for plan fiduciaries and participants evaluate the reasonableness of their 401(k) fees. To do that, it must report the fee information necessary to develop reliable 401(k) fee benchmarks. Here is the additional information we’d like to see:

- All Form 5500 versions:

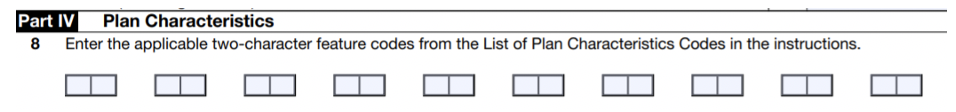

- Add a code to report indirect service provider compensation – The Form 5500 and 5500-SF have a section to report plan features by code. I think all Form 5500 versions should include a code for indirect service provider compensation so plan fiduciaries and participants can quickly identify whether their plan pays these hidden 401(k) fees.

- Add a code to report indirect service provider compensation – The Form 5500 and 5500-SF have a section to report plan features by code. I think all Form 5500 versions should include a code for indirect service provider compensation so plan fiduciaries and participants can quickly identify whether their plan pays these hidden 401(k) fees.

- Form 5500 only:

- Add indirect service provider compensation to the new schedule of assets attachment – While I like the new Schedule of Assets (Held At End of Year) proposal, I think it should also report the portion of fund operating expenses attributable to indirect service provider compensation.

- Form 5500-SF only:

- Add a weighted average of fund operating expenses – The agencies did not propose any fee-related changes to the Form 5500-SF. I would like to see the return report the weighted average of fund operating expenses (based on fund balance). This additional information should help plan fiduciaries and participants evaluate their plan's “all-in” fee.

Transparency is the Best 401(k) Fee Disinfectant!

401(k) providers can charge dramatically different fees for plan administration and investments. For plan fiduciaries and participants to know they’re not overpaying, they need reliable 401(k) fee benchmarks.

In my view, the Form 5500 would be the most cost-efficient way to collect the necessary 401(k) fee data. To make that happen, only some basic changes to the return would be necessary.